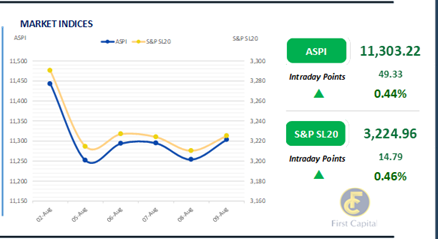

The bourse experienced a day of positive sentiment rebounding from the losses recorded during the past few trading days. The ASPI closed at 11,303, gaining 49 points and marking a 0.44% increase from the previous day to which the most significant contributors were SAMP, RICH, SPEN, LOLC, and AEL, reflecting bargain hunting amongst banks and blue-chip firms.

The lack of activity from both HNW investors and retailers during today's market triggered the turnover to decline to LKR 403.4Mn, displaying a 36% decrease from the previous day, where the Capital Goods sector led turnover by 29%, followed by the Food, Beverage and Tobacco, and Banking sectors jointly contributing to 45% of overall turnover.

There was a net foreign inflow of LKR 24.3Mn signaling interest in local investments. The market overall saw a day of positive sentiment alongside an improved environment and the presence of bargain buying activity.

Bond Market wraps cautious ahead of the bond auction

The secondary bond market yield curve remained broadly unchanged amidst limited trading activity and thin trading volumes as market participants remained on the sidelines ahead of the upcoming LKR 60.0Bn worth bond auction announced yesterday.

On the bond auction that will be taking place on 13th August 2024, CBSL is expected to raise LKR 45.0Bn from 15.06.29 and LKR 15.0Bn from 01.10.32 respectively. Meanwhile, among the traded maturities, notable trades were amongst the mid tenors, where 15.09.29 traded at rates of 12.65%.

The secondary market mirrored previous trends with ongoing rate increases amid continued uncertainty. On the external front, LKR appreciated slightly against USD, closing at LKR 301.2/USD compared to LKR 301.9/USD recorded the previous day.

Additionally, the LKR experienced slight depreciation against the AUD and GBP but appreciated against the EUR, JPY, and CNY. Meanwhile, CBSL Holdings remained stagnant at LKR 2,575.6Bn today for the 11th consecutive day. However, overnight liquidity in the banking system increased to LKR 107.4Bn from LKR 80.2Bn recorded the previous day.

Courtesy: First Capital Search

Subscribe to our newsletter to get notification about new updates, information, etc..