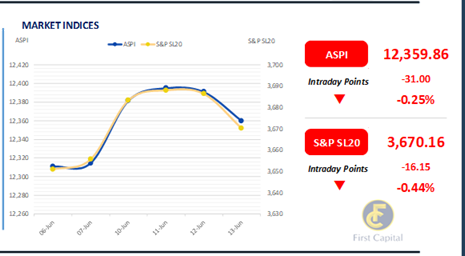

The bourse continued its course in a negative direction amidst another day of low sentiment. The ASPI closed at 12,360, marking a 0.25% decrease from the previous day to which banks and conglomerates contributed the most significantly towards the negative index, led by SAMP, NDB, HAYL, BIL, and LOLC.

Conversely, MELS, SEMB, SPEN, RICH, and DIAL were the most significant positive contributors towards ASPI. Increased negative activity and uncertainty within the market can be attributed to anticipation regarding the confirmation of debt restructuring from private creditors following the IMF 2nd review.

An increased number of crossings took place primarily amongst banks and conglomerates. Turnover saw an increase, standing at LKR 1.8Bn, where the Banking sector led turnover at 40%, followed by the Insurance, and Capital Goods sectors jointly contributing to 26% of overall turnover, further exhibiting volatility within the market as a result of increase bargain buying activity particularly amongst banks, HNWIs, and insurance firms. There was a net foreign outflow of LKR 82.9Mn, signaling interest in outward investments. The market overall experienced a day of diminished sentiment primarily amongst banks.

Revitalized high investor participation post Bond auction

The secondary market witnessed moderate volumes backed by high investor participation post the year’s biggest T-Bond auction which was held today.

Influenced by the Bond auction, there was notable buying interest centred on short tenors namely 2027 and 2028. Furthermore, 01.05.27 traded at 10.50%, 15.09.27 traded at 10.70% whilst 2028 maturities, namely 15.01.28, 15.03.28, 01.05.28, 01.07.28 and 01.09.28 traded between the range of 11.20%-11.00%.

Consequently, 15.09.29 traded between the range of 11.90%-11.80% and 01.12.31 traded at 12.00%.CBSL conducted its biggest auction of the year, offering LKR 295.0Bn from 15.10.27, 15.09.29 and 01.12.31 tenors, where the total amount offered was fully accepted.

Furthermore, 15.10.27 was accepted at a weighted average yield of 10.69%, 15.09.29 was accepted at a WAYR of 11.78% alongside 01.12.31 at a WAYR of 12.03%.There was higher reception across the board where 15.10.27 displayed 2.5 times higher reception than the LKR 60.0Bn offered, whilst 15.09.29 also gained higher reception of 1.4 times (compared to the LKR 125.0Bn offered) followed by 01.12.31 gaining 1.7 times higher reception compared to the LKR 110.0Bn offered.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..