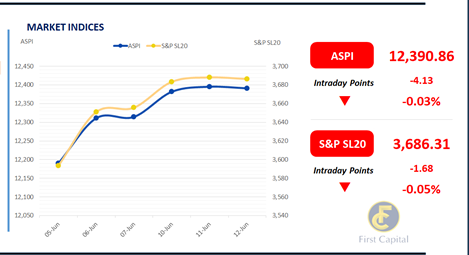

The market experienced a session of mixed sentiment and moderate turnover, as uncertainty surrounding the upcoming IMF 2nd review, pushed the index to down by 4 points to close the day at 12,391.

Both retail investors and HNWIs made a significant contribution to the index, while conglomerates, banks, and leasing companies gained momentum, alongside the hotel sector counters.

HAYL, COMB, PLC, VLL and HHL emerged as significant contributors to the index. Meanwhile turnover stood at LKR 1.7Bn, with 55.7% down from yesterday.

However, 4.1% up from the monthly average standing at LKR 1.6Bn. The Capital Goods sector led the turnover at 24.3%, with Diversified Financials and Banking sectors jointly contributing 45.3% to the overall turnover. Foreign investors remained net sellers for the 8th consecutive day, recording a net outflow of LKR 39.1Mn.

Auction yields shoot up for the 2nd consecutive session

The CBSL fully accepted the total offered of LKR 215.0Bn at today’s weekly bill auction while auction yields saw an uprise across the board for the second consecutive session.

Accordingly, weighted average yield rate of 03M and 06M bills edged up to 8.89% (+19bps) and 9.30% (+26bps), respectively while 01Yr bill closed higher at 9.54% (+27bps). Meanwhile, in the secondary market activities took a lackluster sentiment as investors cautiously awaited the upcoming bond auction scheduled for tomorrow.

Following the auction, investors adjusted their quoted prices upward, expressing surprise at the auction's results; however, no trades were executed. Moreover, amidst subdued activity, 2028 maturity enticed slim interest during the session with 15.01.2028 closing at 11.10% whilst 01.05.2028 and 01.07.2028 registered trades at 11.15%. Also, 15.05.2030 observed trades at 11.90% levels during the day.

The outcome of tomorrow’s significant LKR 295.0Bn T-Bond auction, along with developments from today's IMF meeting, will be pivotal in shaping investor sentiment in the near term. Meanwhile, on the external side, LKR depreciated against the greenback, closing at LKR 303.5.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..