The bourse continued its upward trajectory for the 4th consecutive day, driven by growing investor confidence amid sufficient progress on the External Debt Restructuring and the negotiations with external bondholders.

The Banking sector counters, and blue chip companies continued to make significant contribution to the index majorly where COMB, JKH, HNB, HAYL and TJL emerged as the key contributors.

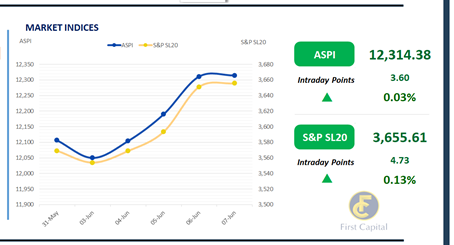

However, the index started on a subdued tone, hitting its intraday low at 12,290 before recovering post midday and concluding the week at 12,314 gaining 4 points.

Meanwhile, due to the low participation of traders, turnover decreased by 18.5% compared to yesterday, amounting to LKR 1.3Bn, marking a 21.9% decline from the monthly average standing at LKR 1.6Bn.

The Banking sector led the turnover at 45.1% as evident by the positive ratings upgrades by Fitch Ratings today. Moreover, Capital Goods and Diversified Financials sectors jointly contributed 26.6% to the overall turnover. Foreign investors remained net sellers, recording a net outflow of LKR 137.7Mn.

Secondary market concludes week amid mixed sentiments

The secondary market experienced a day of mixed sentiment characterized by limited activity and thin trading volumes. Selling interest was evident in short to mid-tenor bonds, particularly those maturing in 2026, such as the 01.02.26, 15.05.26, and 15.12.26 maturities, which traded within the range of 9.65%-10.10%.

Similarly, bonds maturing in 2028, including 15.01.28, 15.03.28, 01.05.28, 01.07.28, 01.09.28, and 15.12.28, saw trading within the ranging of 10.90%-11.10% range. In contrast, there was a slight uptick in buying interest at the tail end of the curve, with the 01.10.32 maturity trading at 11.95%.

Moreover, CBSL announced an issue of LKR 215.0Bn in T-Bills through an auction scheduled on the 12th of June 2024, out of which LKR 40.0Bn is to be raised from the 91-day maturity, LKR 100.0Bn is expected to be raised from the 182-day maturity, whilst another LKR 75.0Bn is to be raised from the 364-day maturity.

Furthermore, overnight liquidity was recorded at LKR 145.6Bn, whilst CBSL holdings decreased to LKR 2,615.6Bn after remaining stagnant at LKR 2,635.6Bn for nearly 2 weeks. On the external side, the LKR continued to depreciate against the USD for the 2nd consecutive week, closing at LKR 302.7 during the day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..