The broader market experienced an upward momentum during first few hours of trading, yet remained sideways towards the latter as investor participation remained low, ultimately resulting in both indices closing in the green.

On days marked by uncertainty, the limited participation of HNWIs was evidenced by the lack of crossings, while index-heavyweights such as MELS, SPEN, LOLC, CTC and LLUB exerted significant positive influences on both the index and turnover.

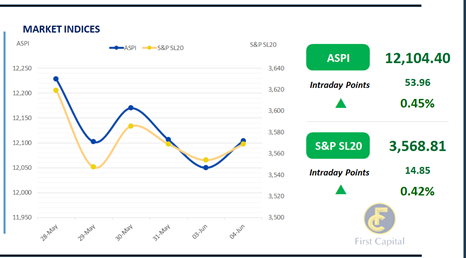

Additionally, a recovery in Banking sector stocks was observed. Accordingly, ASPI closed at 12,104, gaining 54 points, recovering slightly by 0.5% compared to yesterday. Meanwhile, turnover experienced a 31.1% increase from the previous day, totaling LKR 900.0Mn, although decreased by 48.1% compared to the monthly average standing at LKR 1.7Bn.

The Food, Beverage, and Tobacco sector led turnover at 20.0%, with the Capital Goods and Materials sectors jointly contributing 38.2% to the overall turnover. Foreign investors remained net sellers, recording a net outflow of LKR 31.1Mn.

Lingering uncertainty surrounds the secondary market

The secondary market yield curve remained broadly stable continuing the sluggish trend from the previous session, backed by limited activity and thin volumes during the day. The subdued sentiment in the market was mainly influenced by the lingering uncertainty ahead of the IMF board meeting which is to be held on the 12th Jun-24 regarding the disbursement of the IMF 3rd tranche alongside the anticipated Bond auction that is scheduled for the 13th Jun-24 which resulted the investors to pivot into a wait and see approach.

Furthermore, 15.12.26 tenor traded at 9.80%, 01.09.27 maturity traded at 10.37%. Towards the long end of the curve 01.10.30 traded between the range of 11.80% - 11.88%. On the external side LKR broadly remained stagnant compared to the USD recording at LKR 301.9. Overnight liquidity was recorded at LKR 161.1Bn whilst CBSL Holding remained stagnant at LKR 2,635.6.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..