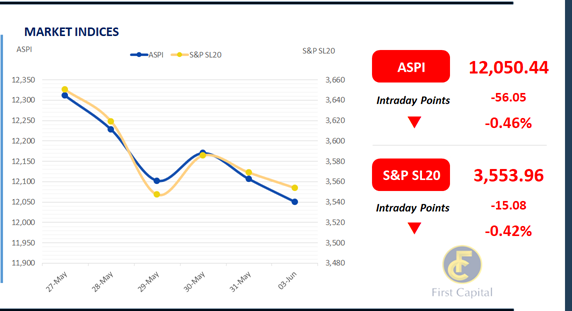

The Colombo bourse continued its course in a negative direction amidst another day of low sentiment and uncertainty. The ASPI closed at 12,050, falling to its lowest levels since April, marking a 0.46% decrease from the previous day, to which the most significant contributors were MELS, JKH, CTC, LOLC, and BIL.

Conversely, COMB, HAYL, ASPH, ABL, and NTB were the most significant positive contributors towards ASPI. Increased volatility and negative activity within the market can be attributed towards reactions and sentiment following the release of Interim Financial Statements.

Additionally, the lack of crossings taking place in today’s market further reflects a decline in investor sentiment, and a dwindling interest from HNWI. Turnover saw a significant decrease, standing at LKR 686.7Mn, falling to its lowest levels in the past week and experiencing a 41.2% decrease from the previous day, where the Food, Beverage and Tobacco sector led turnover at 21%, followed by the Capital Goods, and Materials sectors jointly contributing to 27% of overall turnover, further exhibiting diminished activity within the market.

There was a net foreign outflow of LKR 68.4Mn, signaling interest in outward investments. The market overall experienced a day of limited activity and sentiment amidst uncertainty.

Yields stay still amidst limited participation

The secondary market yield curve remained broadly stable, reflecting subdued activity and thin trading volumes across the market. Among the traded maturities, 15.09.27 was seen trading at 10.40% while on the mid end, 2028 maturities including 15.03.28, 01.05.28 and 01.07.28 changed hands at 10.75%, 10.85% and 10.80%, respectively.

Meanwhile, on the long end of the curve, 01.10.32 traded at 11.85%. Moreover, CBSL announced an issue of LKR 235.0Bn T-Bills through an auction to be held on 5th Jun 2024, out of which LKR 40.0Bn is to be raised from 91-day maturity, LKR 75.0Bn is expected to be raised from 182-day maturity while LKR 120.0Bn is to be raised from 364-day maturity.

On the external front, the LKR remained steady against the USD, closing at LKR 301.9/USD. During the week ending 31st May 2024, the AWPLR declined by 32bps and concluded the week at 9.36%. Moreover, foreign holdings in government securities decreased by 4.1%WoW and registered at LKR 71.5Bn as of 30th May 2024.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..