The bourse experienced a mixed sentiment amid ongoing uncertainties ultimately closing both indices in green today with active participation from the HNWIs.

Despite yesterday's panic selling following COMB's Rights Issue announcement, COMB made a positive contribution to the index, while the Banking sector, led by NDB, SAMP, and DFCC, largely buoyed the index alongside conglomerates such as RICH and dividend declared companies.

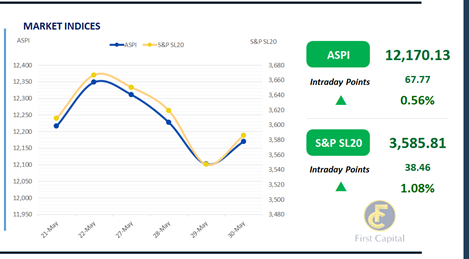

Accordingly, the ASPI closed at 12,170, gaining 68 points (c.0.6%), after dipping to its intraday low at 12,086 post-midday and surged into a bullish run.

Meanwhile, turnover saw a notable rebound surging by 11.0%WoW to reach LKR 1.3Bn, however 38.9% lower than the monthly average standing at LKR 2.1Bn.

Off the board transactions contributed 35.7% to the total turnover. The Banking sector led turnover at 38%, followed by the Food, Beverage and Tobacco, and Capital Goods sectors jointly contributing to 35% to the overall turnover.

Bonds wrap the day on a flat note

The secondary market yield curve remained broadly unchanged as the overall market witnessed dull sentiment while recording thin volumes. Limited trades were observed particularly on short to mid tenors such as 15.09.27 and 01.05.28 which traded at 10.40% and 10.75%, respectively. Meanwhile on the long end, 01.10.32 changed hands at 11.85%. On the external front, the LKR depreciated against the USD, closing at LKR 301.5/USD.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..