The market experienced a bearish trend throughout the trading day, primarily due to lingering uncertainties within the country, albeit with a modest level of engagement observed from HNWIs, closing both indices in red.

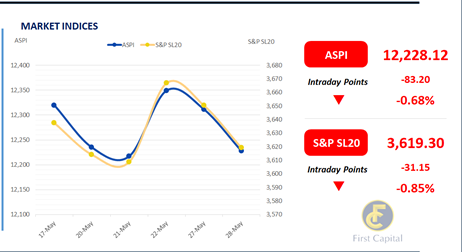

ASPI hit its intraday low at 12,214 before ending the day at 12,228 losing 83 points (c.-0.68%). Banking sector counters such as HNB, COMB, NDB, and SAMP, along with JKH, exerted a downward pull on the index while contributing to the turnover.

In contrast to yesterday, turnover experienced a slight recovery, witnessing an 85.2% increase and reaching LKR 915.8Mn. However, representing a significant 61.1% reduction from the monthly average at LKR 2.4Bn.

This signifies a decline in retail investor participation, with fewer than 10,000 trades executed during the day. The banking sector dominated turnover at 41%, with the Capital Goods and Food, Beverage and Tobacco sectors jointly contributing 31% to the overall turnover. Foreign investors maintained a net buying position, with a net inflow of LKR 63.9Mn.

CBSL maintains its monetary policy stance

The CBSL maintained its monetary policy stance at the 3rd meeting for the year, maintaining the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) at 8.50% and 9.50%, respectively. This decision led to a modest selling interest in the market, signaling a perception that rates have reached their lowest point.

Consequently, liquid tenors including 01.08.26 and 15.12.26 saw trading in the range of 9.95%-10.05%, with 15.09.27 exchanging at 10.50%. Meanwhile, 2028 tenors such as 15.01.28, 15.03.28, 01.07.28, and 15.12.28 traded between 10.80%-11.00%.

On the external front, the LKR depreciated against the USD, closing at LKR 300.42/USD. Moreover, overnight liquidity for the day was recorded at LKR 190.7Bn while CBSL holdings remained steady at LKR 2,635.6Bn

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..