The broader market exhibited a long-lived bullish sentiment throughout the trading day with active participation of the HNWIs closing both indices in green.

Banking sector counters like COMB, HNB and NDB and conglomerates such as LOLC and JKH led the market activity today contributing to both turnover and index.

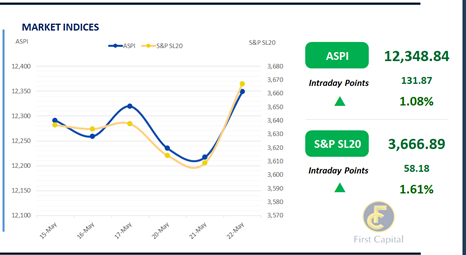

Accordingly, the ASPI closed the short week at 12,349 gaining 132 points (c. 1.1%). This uptick signals a potential recovery from the recent downward trend that had persisted over the past few days.

The decline in rates observed in yesterday's treasury bill auction, coupled with the looming CBSL policy meeting, likely contributed to this positive momentum.

Meanwhile turnover saw as a slight recovery from yesterday with a 12% increase, reflecting positive sentiment in the market, standing at LKR 1.5Bn, however 41% down from the monthly average at LKR 2.5Bn.

Banking sector led turnover at 32%, followed by the Capital Goods and Diversified Financials sectors jointly contributing to 34% of overall turnover. Foreign investors turned Net sellers, with a net outflow of LKR 57Mn.

Yield curve broadly rests as market eases

The secondary market yield curve broadly remained unchanged, pivoting from the buying sentiment displayed during the previous session, backed by moderate activity.

Trades were witnessed across the board whilst, short tenor maturities 2026, traded between the range of 9.90%-9.80% and 15.09.27 maturity traded at 10.30%. Moreover, 2028 maturities, 15.01.28 traded at 10.50%, 01.07.28 traded at 10.72%, 15.12.28 traded at 10.80%.

Furthermore 01.10.32 traded at 11.80%. Moreover, CBSL overnight liquidity figure improved during the day and recorded at LKR 194.4Bn whilst, CBSL holdings remained stagnant at LKR 2,655.6Bn. On the external side LKR broadly remained stagnant against the green back recording at LKR 299.7.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..