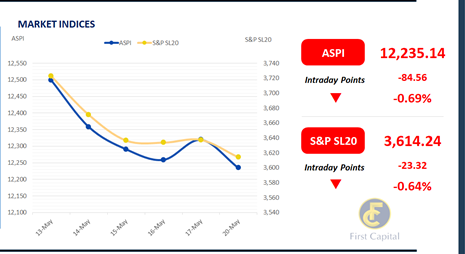

The broader market experienced a volatile trading day, with both indices closing in red, influenced by the lingering uncertainties in both the local and global environment.

The bourse commenced the week with a bearish note, echoing the uncertainties from the previous week by closing the index at 12,235, losing 85 points (c. -0.69%) while bouncing back from its intraday low of 12,174.

LOLC, COMB, JINS, RCL and CFIN contributed to the index negatively, out shadowing the contribution from the less number of positive contributors.

Meanwhile, the turnover fell to a two month low and stood at LKR 1.1Bn by drastic 57.0% down from the monthly average standing at LKR 2.5Bn amidst the active participation of the retail investors.

Capital Goods sector led turnover at 21%, evident by improvement in Purchasing Managers’ Index for month of April, followed by the Banking and Food, Beverage and Tobacco sectors jointly contributing to 33% of overall turnover while most of the sectors witnessing declines. Foreign investors turned net buyers, with a net inflow of LKR 24.6Mn.

Yields inch up amidst selling interest

The secondary market yield curve inched up mainly on the short to mid tenor maturities amidst slight selling interest enticed ahead of the LKR 160.0Bn T-Bill auction scheduled for 21st May 2024.

Notably, liquid tenors such as 01.02.26, 01.08.26, and 15.12.26, saw transactions occurring within the range of 10.00% to 10.21%, with the 15.09.27 maturity changing hands at 10.45%.

Furthermore, maturities for 2028, such as 01.05.28, 01.07.28, and 15.01.28, traded within the range of 10.60% to 10.80%. Moreover, the mid end maturities 15.05.30 and 15.10.30 were transacted between 11.65% and 11.70%, while the tail-end maturity of 01.10.32 traded between 11.90% and 11.95%.

On the external side, LKR appreciated against the greenback closing strongly below LKR 300.0 mark after a week. During the week ending 17th May 2024, the AWPLR continued its downward trajectory, experiencing a decline of 27bps WoW and concluding at a nearly two-year low of 9.65%.

Moreover, foreign holdings in government securities decreased by 1.5%WoW and registered at LKR 75.9Bn as of 16th May 2024.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..