The market experienced another day of downturn, marking the 3rd consecutive session of bearish sentiment. Initially showing signs of recovery with a positive start, the market soon succumbed to ongoing uncertainties and profit-taking activities.

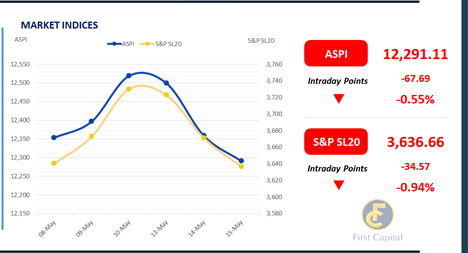

Accordingly, ASPI experienced a downward trend, closing at 12,291, shedding 68 points (c. -0.55%). This decline was particularly influenced by the selling pressure observed on the Banking sector counters like HNB, NDB, SAMP and DFCC, as selling pressure persisted amidst lingering uncertainties, despite the recently released satisfactory results.

Meanwhile, the turnover stood at LKR 3.2Bn making a 3.9% decrease from yesterday, however 25.5% increase from the monthly average of LKR 2.5Bn. Significantly, off-the-board transactions accounted for 41.9% of the turnover, indicating substantial involvement from HNWIs.

Consumer Durable sector led turnover at 32%, followed by the Banking and Capital Goods sectors jointly contributing to 39% of overall turnover. Moreover, there was notable interest observed in the Hotel sector counters. Foreign investors turned net buyers, recording a net inflow of LKR 772.1Mn.

Auction yields taper down across the board

CBSL conducted its weekly T-Bill auction where weighted average yields declined across the board for the 6th consecutive week. The total offered amount of LKR 177.5Bn was fully accepted with 1Yr bill being oversubscribed amidst higher reception.

Accordingly, weighted average yield rates declined by over 30bps across all maturities with 03M closing at 9.04% (-39bps), whilst 06M and 1Yr bills closing at 9.43% (-33bps) and 9.57% (-33bps), respectively.

In the secondary market, during early trading hours buying interest activated on 15.05.2030 maturity which traded at 11.50%. Moreover, on the short end, 15.12.2026 traded between 10.00%-9.93% whilst 01.05.2027 and 15.09.2027 traded within a range of 10.25%-10.20% as buying sentiment progressed.

However, post auction, investor interest slightly reversed with a perceptible mixed sentiment. Accordingly, on the 2028 tenor, 15.03.2028, 01.05.2028, 01.07.2028 and 15.12.2028 hovered in a range between 10.50%-10.65%. Moreover, 01.10.2032 closed trades for the day between 11.80%-11.85%. On the external market, rupee depreciated against the USD for the third consecutive day closing at LKR 300.8.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..