Bourse recorded solid gains during today’s session led by active participation on banks as investors fervently collected banking counters following the continuous profit booking that persisted during the previous sessions.

LOLC and BIL who are major investors in the Colombo Port City drew interest following the gazette issued for incentives and tax exemption. Meanwhile, with tourist arrivals reaching record highs after months hotel sector counters displayed gains during the session.

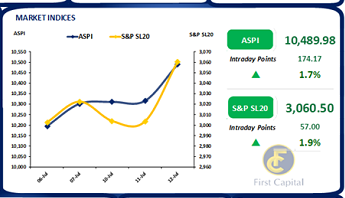

In addition to banking counters, buying appetite was observed on bluechip companies too while the index closed at 10,490 gaining 174 points. Moreover, market turnover was recorded at LKR 3.1Bn (+27% cf. monthly average turnover of LKR 2.4Bn) dominated by the Capital Goods sector (24%) while Food, Beverage & Tobacco sector contributed 18%.

Yield curve slants higher over mixed activity

The secondary market witnessed mixed sentiment ahead of the bond auction tomorrow whilst the yield curve budged higher. Moreover, with emerged selling interest, 15.05.26 maturity changed hands at 15.00%.

Furthermore, 15.09.27 maturity displayed mixed activity as it hovered between 14.45%-15.00% whilst 15.01.28 maturity traded between 14.00%-14.50%. Meanwhile at the weekly bill auction LKR 99.7Bn was accepted out of LKR 160.0Bn offered by the CBSL whilst the weighted average yield rates edged higher as 3M, 6M and 1Yr bills witnessed an uptick to 19.08% (+129bps), 16.95% (+102bps) and 14.04%(+18bps) respectively. Meanwhile in the forex market LKR slightly depreciated against the greenback recording LKR 313.90.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..