Investor sentiment at the Colombo Bourse remained mixed, extending the trend from the previous session. The index saw a sharp downturn in early trading driven by profit-taking activity.

Although the market gradually stabilized with sideways movement throughout the day, it failed to fully recover from the previous day's losses.

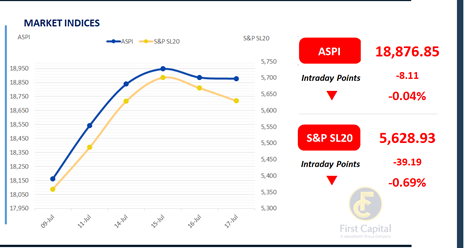

Ultimately, the ASPI closed marginally lower, shedding 8 points to end at 18,877. JKH, COMB, MELS, SAMP and NDB emerged as the top negative contributors to the index.

Amidst high participation from HNW and retail investors turnover stood at LKR 6.2Bn, representing a 4% decrease from the monthly average standing at LKR 6.5Bn.

The Consumer Services sector dominated activity, accounting for 34% of total turnover, followed by the Capital Goods and Banking sectors, which jointly contributed around 38%. Foreign investors turned net sellers with a net outflow of LKR 115.2Mn.

BOND MARKET

Secondary market remains subdued amid minimal activity

The secondary bond market continued to exhibit low activity today, extending the muted sentiment seen in the previous sessions. Trading volumes remained extremely limited.

Among the few transactions that did occur, short-term maturities, specifically the bonds maturing on 01.05.2028, 01.07.2028, and 15.10.2028 were traded within a yield range of 8.85% to 8.97%.

In the forex market, the LKR depreciated against the greenback, closing at LKR 301.3/USD, compared to the previously seen rate of LKR 301.0/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 85.9Bn from the previously seen level of LKR 86.5Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..