The Colombo Bourse failed to sustain its bullish momentum for the fifth consecutive day, as selling pressure from profit-taking weighed on the market.

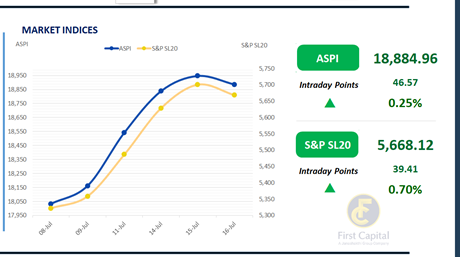

Key counters such as JKH, HAYL, CFIN, MELS, and RCL pulled the index lower. Despite the selling pressure, the ASPI saw only a modest decline of 61 points, closing at 18,885.

A key highlight of the day was the sharp surge in turnover, which hit a high in over one month, reaching LKR 17.0Bn, an increase of 184% compared to the monthly average of LKR 6.0Bn, driven primarily by LKR 10.8Bn worth of HNB.X crossings across 207 trades.

Notable high net worth investor participation was observed. The Banking sector dominated activity, accounting for 76% of total turnover, followed by the Capital Goods and Food, Beverage & Tobacco sectors, which jointly contributed around 10%. Foreign investors turned net buyers with a net inflow of LKR 63.6Mn.

BOND MARKET

Secondary market remains subdued amid light volumes

The secondary bond market remained largely inactive today, continuing the subdued momentum observed in the previous session. Trading volumes were minimal, with only slight selling interest emerging across the curve.

Amongst the few trades that were carried out today, at the short end of the yield curve, both 15.10.2029 and 15.12.2029 traded between 9.47% to 9.51%. Moving ahead of the yield curve, 01.11.2033 traded between 10.72% to 10.80%.

The Central Bank concluded its weekly Treasury Bill auction today, fully raising the initially offered LKR 85.0Bn, with yields edging higher across all maturities. The 3M bill generated LKR 7.4Bn, with its weighted average yield rising by 2 bps to 7.62%. The 6M bill raised LKR 55.8Bn, recording a 7bps increase to 7.91%.

Meanwhile, the 12M bill drew LKR 21.8Bn, with its yield climbing 5bps to 8.04%. In the forex market, the LKR remained broadly unchanged against the greenback, closing at LKR 301.0/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 86.5Bn from the previously seen level of LKR 84.3Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..