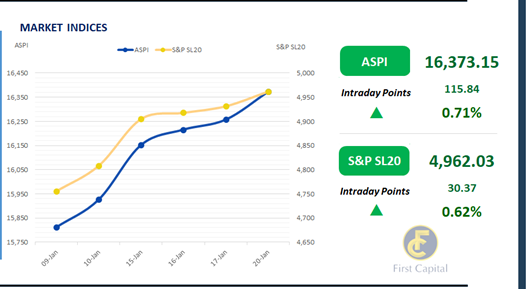

The market experienced a day of positive sentiment, maintaining positive momentum throughout the day. The ASPI closed at 16,373, which depicts a 0.71% increment, attributed to increase in both HNW and retail participation.

During today’s trading session, investor attention was focused on Banking sector counters such as DFCC, HNB, PABC and NDB. Increased buying interest was noted in TJL, resulting in the stock price responding positively.

NDB, TJL, DFCC, CCS and HNB emerged as the top positive contributors to the index. Turnover stood at LKR 5.6Bn, marking a 21.5% decrease from the monthly average. SIRA attracted HNW and retail attention, contributing to a significant portion of today’s turnover.

Overall, the Capital Goods sector led the turnover with a 24% contribution, followed by the Banking and Food, Beverage & Tobacco sectors jointly contributed 36%. There was a net foreign outflow of LKR 55.3Mn signaling interest in external investments.

Low volumes persist ahead of T-Bill auction

The secondary market yield curve witnessed a day of low volumes and limited activity as dull sentiment persisted and investors adopted a wait-and-see approach ahead of the treasury bill auction to be held on 22nd Jan-25, where the CBSL is scheduled to raise LKR 155.0Bn in T-Bills.

Amongst the traded maturities, notable trades were on the short to mid end of the curve, primarily amongst the 2027, 2028, and 2030 maturities. On the short end of the curve, 15.05.26 traded at a rate of 8.95%.

Similarly, 15.01.27 and 01.05.27 traded at rates of 9.30% and 9.70%, respectively. On the belly end of the curve, 15.01.28, 15.03.28, and 01.05.28 traded at rates of 10.10%, 10.18%, and 10.31%, respectively.

The 15.10.30 maturity traded at a rate of 11.30%. Meanwhile, on the external front the LKR depreciated against the USD closing at LKR 296.66/USD compared to LKR 296.51/USD recorded the previous day.

CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 134.69Bn from LKR 126.30Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..