The stock market saw another day of positive sentiment and gains, driven by the decrease in treasury bill yields at the recent treasury bill auction.

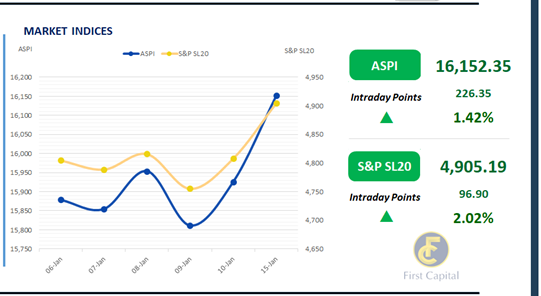

Amidst a slight increased participation from retail and HNW investors, ASPI closed the day in green at 16,152, gaining 226 points marking a 1.42% increase from the previous day.

The most significant contributors towards the positive index were SAMP, DFCC, NDB, HNB, and COMB. During today’s trading session, most of the investor attention was focused on Banking sector and Blue-chip stocks such as JKH.

Meanwhile, turnover stood at LKR 4.4Bn, marking a decrease of 38.5%, from the monthly average. Moreover, the Banking sector led the turnover by 30%, followed by the Capital Goods and Food, Beverage and Tobacco sectors jointly contributing 30% of the overall turnover. There was a net foreign outflow of LKR 312.6Mn.

Yield curve declines at the short end following weekly T-Bill auction

CBSL conducted the weekly T-Bill auction, raising LKR 107.0Bn, with the total offered amount being fully accepted across all maturities. Bids received for all the three maturities exceeded the total offered amount, with the 06M T-Bill attracting the most interest, same as the last T-Bill auction.

Meanwhile, weighted average yield rates declined across the board for the sixth consecutive week at today’s T-Bill auction. The 03M T-Bill closed at 8.33% (-14bps), the 06M T-Bill at 8.44% (-16bps), and the 1Yr T-Bill at 8.80% (-10bps).

During today’s trading session the secondary market yield curve experienced moderate trading volumes whilst the post T-Bill auction 03M and 06M T-Bills traded at the rates of 8.25% and 8.35% respectively.

Amongst the traded maturities, at the short end 01.02.2026 and 01.06.26 and 01.08.26 bonds traded at the range of 9.15% to 9.00%, while the 15.09.2027 and 15.10.27, traded at the range of 9.85% to 9.80%.

Furthermore, towards the mid-end of the curve 15.03.28, traded in the range of 10.20% to 10.10% whilst 01.05.28 and 01.07.28 traded in the range of 10.38% to 10.26%. Towards the belly end 15.10.28 and 15.12.28 traded at the range of 10.45% to 10.40%.

Meanwhile, on the external front, the LKR appreciated against the USD closing at LKR 294.6/USD compared to LKR 295.6/USD recorded the previous day. CBSL holdings of government securities declined to LKR 2,511.92Bn today. Overnight liquidity in the banking system contracted to LKR 79.61Bn from LKR 130.26Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..