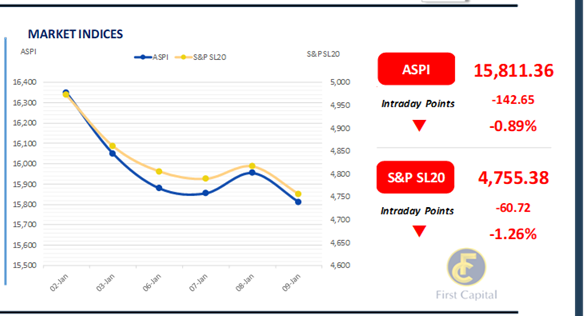

The Colombo Stock Market experienced a downtrend as investors maintained a negative stance during the trading day, shifting from the positive sentiment observed during the previous day.

Moreover, selling pressure in the Banking sector counters dragged the ASPI down. As a result, the ASPI halted the day at 15,811 losing 143 points, despite the index climbing higher in the first few hours of trading.

SAMP, COMB, MELS, DFCC and LOLC emerged as the top negative contributors to the index. Amidst less participation from retail and HNWs investors, turnover stood at a lower LKR 4.1Bn, marking a decrease of 44.2%, from the monthly average standing at LKR 7.4Bn.

Moreover, the Capital Goods sector led the turnover by 23%, followed by the Food, Beverage and Tobacco and Banking sectors jointly contributing 38% of the overall turnover. Meanwhile, the net foreign outflow for the day stood at LKR 38.0Mn.

First Bond auction for the year notches a partial acceptance

The Central Bank of Sri Lanka conducted its first T-Bond auction for the year, expecting to raise LKR 190.0Bn. However, the auction saw a partial acceptance rate of 94.0% for the total amount offered.

Specifically, only LKR 39.3Bn was accepted from the 01.11.2033 bond, where LKR 50.0Bn was initially expected to be raised. In contrast, the 15.10.2028 and 15.10.2030 bonds saw full acceptance, with the total offered amounts of LKR 60.0Bn and LKR 80.0Bn, respectively, being fully subscribed.

The weighted average yield rates for the 15.10.2028 and 15.10.2030 bonds were 10.42% and 11.23%, respectively, while the 01.11.2033 bond closed at a yield of 11.47%. Post auction, there was an uptick in buying activity in the secondary market, particularly for mid-tenor bonds.

Various maturities of the 2028 bond traded, with the 01.05.2028 bond hovering between 10.30% -10.23%, while the 01.07.2028 bond closed at 10.35%.

Additionally, the 15.10.2028 and 15.12.2028 bonds saw trades between 10.45%-10.37%, and 10.50%-10.45%, respectively. During the day, the 15.09.2029 bond registered transactions around the 10.80% level, while the 15.05.2030 bond traded between 11.05% -11.00%. Finally, the 15.10.2030 bond closed transactions at 11.30%.

Meanwhile, on the external side, LKR slightly appreciated against the greenback closing at LKR 296.09/USD compared to yesterday’s closing of LKR 296.15/USD.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..