Colombo Bourse experienced a price decline across most sectors as investors displayed profit taking sentiment during today’s trading session with activity visible on selected Banking and Conglomerates sectors.

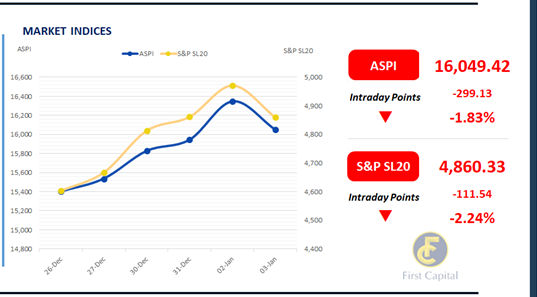

Additionally, SAMP, COMB, LOLC, MELS and HAYL emerged as the top negative contributors to the index. Amidst this market volatility, the ASPI closed the day in red at 16,049 losing 299 points.

Amidst the increased participation from retail investors and low participation from HNW investors, turnover stood at LKR 11.5Bn, marking an increase of 73.2%, from the monthly average.

The Banking sector led turnover at 20%, followed by Capital Goods and Food, Beverage and Tobacco sectors jointly contributing 38% of overall turnover. Meanwhile, the net foreign inflow for the day stood at LKR 142.0Mn.

Yield curve dips from the short end amidst mixed activity

The secondary bond market yield curve showed mixed activity, with buying interest primarily concentrated on 2026 and 2027 maturities where 2026 traded between 8.90% to 9.50% whilst 2027 maturity traded in the range of 9.90% to 9.80%.

Meanwhile, the selling pressure was focused on the belly of the curve with 15.02.28, 01.05.28, 15.10.28 and 15.09.29 traded at 10.13%, 10.30%, 10.40% and 10.75% respectively. Meanwhile, the overnight liquidity level increased and recorded at LKR 160.16Bn compared to yesterday’s level of LKR 149.36Bn.

Moreover, CBSL Holdings continued to remain stagnant at LKR 2,515.62Bn during the day. On the external side, LKR appreciated slightly against the greenback and closed at LKR 293.27/USD compared to previous day’s closing of LKR 293.41/USD.

Similarly, the rupee appreciated against other major currencies including the GBP, EUR, JPY and CNY. Furthermore, for the week ending 27th Dec-24 AWPR witnessed a 34bps and recorded at 9.06% compared to the previous week.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..