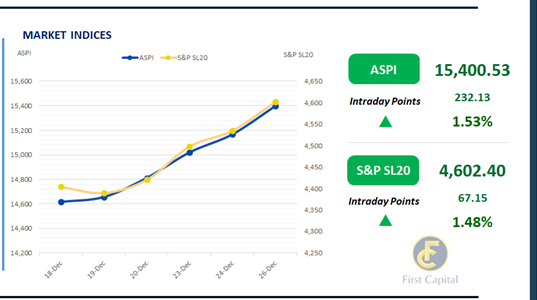

The bourse experienced another day of positive sentiment and increased gains, closing in the green for the 22nd consecutive day, with the ASPI rising by 232 points to close the day at 15,401, marking a 1.53% increase from the previous day.

The weekly T-Bill auction reported an interest rate decline across the board, which sparked increased activity in the stock market. As a result, there was a notable rise in participation from retail investors.

The most significant contributors towards the positive index were LOLC, HNB, SUN, SAMP, and SPEN. The Diversified Financial sector experienced a notable increase, making a significant contribution to both turnover and overall returns.

Amidst multiple off-board transactions, turnover stood at LKR 7.0Bn, marking an increase of 39.8%, from the monthly average. Moreover, the Capital Goods sector led the turnover by 20%, followed by the Food, Beverage and Tobacco and Banking sectors jointly contributing 31% of the overall turnover. There was a net foreign inflow of LKR 20.8Mn.

Dull sentiment emerges following the holiday season

The secondary market yield curve witnessed limited market activity and ultra-thin volumes, as market participants maintained a subdued sentiment following the holiday season.

Among the traded maturities, 15.02.2028 and 01.07.2032 were traded at rates of 10.10% and 11.48%, respectively. Additionally, the CBSL plans to raise LKR 80.0Bn in treasury bonds through two maturities from an auction scheduled for 30th Dec-24.

Meanwhile, on the external front, the LKR depreciated against the USD, closing at LKR 296.48/USD compared to LKR 295.61/USD recorded the previous day.

Similarly, the LKR depreciated against other major currencies such as the GBP, EUR, AUD, CNY, and JPY. CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today.

Overnight liquidity in the banking system inclined slightly to LKR 160.30Bn from LKR 159.37Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..