The bourse witnessed heightened volatility, driven by mixed sentiment and increased market activity, as selling pressure followed a strong rally the previous day.

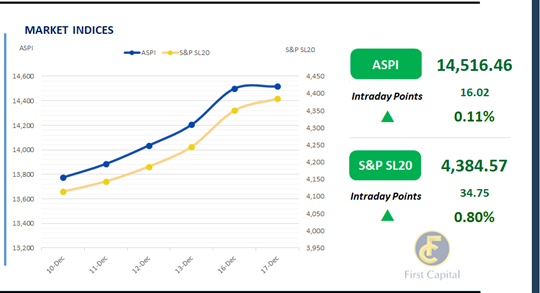

Amidst the increased participation from retail investors, the ASPI closed the day in green at 14,516 gaining 16 points, marking a 0.11% increase from the previous day.

The most significant contributors towards the positive index were JKH, COMB, NDB, CARG, and LIOC while the top negative contributors were SAMP, CINS, HNB, CFIN, and CTC.

Meanwhile, turnover stood at LKR 6.4Bn, marking a 40.3% increase from the monthly average. Moreover, the Banking sector led the turnover by 29%, followed by the Capital Goods, and Materials sectors jointly contributing 36% of the overall turnover. There was a net foreign inflow of LKR 336.2Mn.

Yield curve dips from the belly end

The secondary bond market yield curve experienced slight buying interest in the belly end of the curve, where it showed a slight dip. The trades were predominantly centered around the 2028 maturities.

Amongst the traded maturities, 15.09.27 and 15.12.27 traded in the range of 9.96% - 9.90%. The 2028 maturities namely 15.02.28 traded between 10.15% to 10.13%, whilst 15.03.28, 01.05-28, 01.07.28 and 15.12.28 maturities were traded at the rates of 10.15%, 10.25%, 10.35% and 10.45%, respectively.

Furthermore, 15.09.29, 01.12.31 and 01.06.33 traded at the rates of 10.70%, 11.35% and 11.42% respectively. During the week ending 13th Dec-24, the AWPLR continued its downward trajectory, experiencing a decline of 27bps to 8.82%.

Moreover, foreign holdings in government securities decreased by 3.1%WoW and registered at LKR 66.1Bn as of 12th Dec-24. Meanwhile, on the external front, the LKR continued to depreciate against the USD for the 2nd consecutive day, closing at LKR 290.76/USD, compared to LKR 290.32/USD recorded the previous day.

Additionally, the LKR depreciated against other major currencies including the GBP, EUR, JPY, CNY, and AUD. CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today. Overnight liquidity in the banking system further contracted to LKR 162.84Bn from LKR 202.12Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..