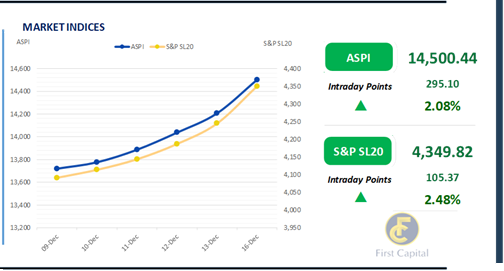

Continuing from the previous week, the Colombo Bourse experienced a sustained bullish momentum with ASPI gaining 295 index points and closed the day in green at 14,500 for the 15th consecutive session.

The S&P SL 20 index also gained 105 points and closed the day in green at 4,350. The bullish momentum can be attributed to declining interest rates and the completion of the external debt restructuring deal, which boosted investor sentiment and reduced risk premiums.

Amongst the off-board transactions a notable transaction was recorded in CINS where 1.6% stake was traded through multiple off-board transactions. Meanwhile, turnover stood at LKR 8.3Bn, marking an increase of 85.3%, from the monthly average, standing at LKR 4.5Bn.

Moreover, the Banking sector led the turnover by 24%, followed by the Capital Goods and Insurance sectors jointly contributing 36% of the overall turnover. Foreign investors remained net buyers, with a net inflow of LKR 100.1Mn.

Buying interest emerges amidst thin volumes

The secondary market yield curve witnessed thin trading volumes and limited activity. Buying interest was experienced primarily on the mid end of the curve ahead of the upcoming T-Bill auction scheduled to be held on 18th Dec-24, which will offer LKR 185.0Bn, out of which LKR 65.0Bn is to be raised for the 91-day maturity, LKR 75.0Bn is to be raised for the 182-day maturity, and LKR 45.0Bn is to be raised for the 364-day maturity.

Notable trades were primarily amongst the 2028 maturities. On the belly end of the curve, 15.03.28, 01.05.28, and 01.07.28 were seen trading between rates of 10.25% - 10.20%, 10.30%, and 10.40%, respectively. Meanwhile, on the external front, the LKR depreciated against the USD, closing at 290.32/USD compared to LKR 290.26/USD recorded the previous day.

Conversely the LKR appreciated against the GBP, closing at LKR 366.78/GBP compared to LKR 367.67/GBP recorded the previous day. The LKR also depreciated against other major currencies such as the EUR, and AUD. CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today. Overnight liquidity in the banking system contracted to LKR 202.12Bn from LKR 215.10Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..