The Colombo Bourse continued its strong bullish momentum, driven by robust participation from both retail and HNW investors.

Almost every sector experienced price gains, with investor sentiment particularly focused on the Banking, Food, Beverage and Tobacco, and selected Construction sector counters.

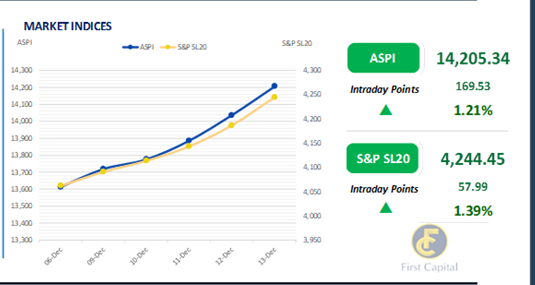

Accordingly, the index gained 170 points and closed the week at 14,205, soaring into new heights. SINS, MELS, HNB, CFIN, and SAMP emerged as the top positive contributors to the index.

Amidst multiple off-board transactions and increased participation from retail investors, turnover stood at LKR 6.1Bn, marking an increase of 40.3%, from the monthly average.

Moreover, the Capital Goods sector led the turnover by 25%, followed by the Banking and Food, Beverage and Tobacco sectors jointly contributing 40% of the overall turnover. Foreign investors remained net buyers, with a net inflow of LKR 126.4Mn.

Secondary bond market activities take a slight pause

The secondary bond market yield curve remained broadly unchanged during today’s session as investors took a breather following the primary market auctions.

Despite limited activities, few maturities on the mid to long end witnessed some trades. Accordingly, on the 2028 bond, 01.05.2028 and 01.07.2028 closed transactions at 10.35% and 10.40% levels, respectively. 15.09.2029 maturity enticed trades at 10.75% while on the long end 15.03.2031 closed at 11.30% during the day.

On the external side, LKR continued to appreciate against the greenback for the third consecutive day. Accordingly, the rupee closed at LKR 290.26/USD compared to yesterday’s closing of LKR 290.30/USD. Similarly, the rupee appreciated against other major currencies such as the GBP, EUR, JPY and AUD during the day. Meanwhile, overnight liquidity levels continued to hover around LKR 200.0Bn levels for nearly a week while closing at LKR 215.10Bn by the end of day today. However, CBSL Holdings remained stagnant at LKR 2,515.62Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..