The bourse experienced a strong start to the day, driven by positive sentiment and increased market activity in the morning.

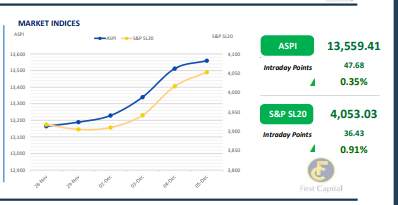

However, by midday, the market slowed down due to a wave of selling pressure. Amidst the increased participation from retail and HNW investors, the ASPI closed the day in green at 13,559, gaining 48 points, marking a 0.35% increase from the previous day.

Additionally, specific stocks in the Banking sector and blue-chip firms continued to attract investor interest throughout the day. The most significant contributors towards the positive index were COMB, SAMP, MELS, HNB, and JKH.

Meanwhile, amidst multiple off-board transactions, turnover stood at LKR 4.5Bn, marking a 24.5% increase from the monthly average. Moreover, the Banking sector led the turnover by 29%, followed by the Capital Goods, and Materials sectors jointly contributing 35% of the overall turnover. Foreign investors turned net buyers with a net inflow of LKR 4.7Mn signaling interest in internal investments.

Secondary bond market sees mixed interest on mid tenors

The secondary bond market yield curve shifted slightly amidst mixed activities which were centered around mid-tenors. Buying interest emerged on the 2027 bonds, resulting in a 10-15bps decline in the yields.

Accordingly, 01.05.2027, 15.09.2027, 15.10.2027 and 15.12.2027 traded within a range of 10.00%- 10.20%. Meanwhile, the 2028 bond and various other maturities experienced mixed activities today.

The morning session saw a surge in buying interest, but this was later overshadowed by selling pressure during the evening session. The secondary market continues to see some profit taking despite emerging buying interest.

Accordingly, on the 2028 maturities, 01.02.2028, 15.03.2028, 01.05.2028, 01.07.2028, 15.10.2028 and 15.12.2028 registered trades between 10.40%-10.60%. Moreover, 15.09.2029 closed transactions at 10.80% whilst 01.10.2032 closed transactions at 11.48%.

On the external side, LKR continued to appreciate against the greenback closing at LKR 290.52/USD compared to yesterday’s closing of LKR 290.54/USD. Similarly, the rupee appreciated against the JPY and AUD.

However, on the contrary, the rupee depreciated against other currencies including EUR, GBP and CNY. Meanwhile, Overnight liquidity closed at LKR 221.89Bn whilst CBSL holdings continued to remain stagnant at LKR 2,515.62Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..