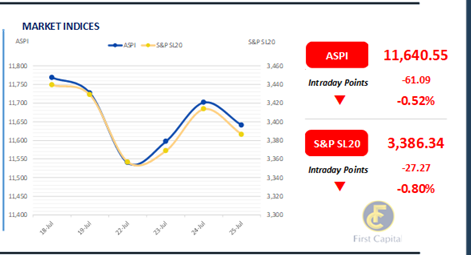

The Colombo bourse slipped into negative territory today, influenced by subdued investor sentiment amid uncertainties regarding the country's political landscape. Consequently, ASPI concluded the day at 11,641, losing 61 points after 2 continuous sessions of gains, reflecting the ongoing market volatility.

The index heavyweights dragged the market down significantly where LOLC, MELS, HNB, COMB and CFIN emerged as the top negative contributors. Despite muted participation of the HNWIs for the second consecutive day retail investors largely contributed to the overall turnover, where turnover stood at LKR 503.2Mn, marking a 58.1% decrease from the monthly average standing at LKR 1.2Bn.

Furthermore, the Banking sector led the turnover with 16%, followed by the Capital Goods and Food, Beverage and Tobacco sectors jointly contributing 30% to the overall turnover.

Bond market remained dried up ahead of the T-Bond auction

The secondary market yield curve remained broadly stable while market activities were at a complete standstill. Investors remained cautious ahead of the Treasury bond auction scheduled for 30th Jul 2024. Limited trades were observed during the day, with the 01.06.26 maturity trading at 10.20% and ultra-thin volumes noted on the 15.05.30 maturity at 12.20%.

Moreover, the Central Bank of Sri Lanka (CBSL) announced the issuance of LKR 200.0Bn worth of T-Bonds through an auction scheduled for 30th Jul 2024. This issuance includes LKR 80.0Bn, LKR 80.0Bn, and LKR 40.0Bn to be issued under the maturities of 15.02.28, 15.10.30, and 01.06.33, respectively.

Meanwhile, the overnight liquidity for the day was recorded at LKR 82.6Bn, whilst CBSL holdings remained steady at LKR 2,595.6Bn. In the forex market, LKR depreciated against the USD today and settled at LKR 303.6. This movement mirrored broader trends as the LKR also depreciated against other major currencies such as the AUD, GBP, and EUR. However, on a YTD basis, the LKR has appreciated against the USD by 6.3%, reflecting a strong overall performance despite recent fluctuations.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..