The Colombo bourse bounced back from five consecutive days of losses, collectively losing 352 points, as majority of the sectors witnessed price gains whilst index heavyweights emerged as the major positive contributors.

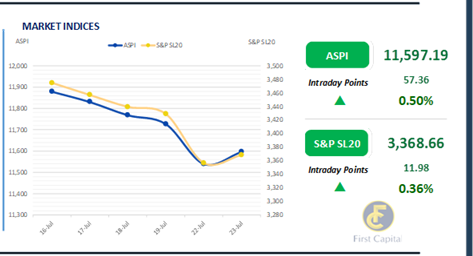

However, trading volumes remained relatively low compared to previous sessions. The ASPI experienced a sluggish morning session but rallied post midday to close the day in green at 11,597 gaining 57 points, further reflecting the ongoing market volatility.

MELS, RICH, COMB, CARG and BIL emerged as the major positive contributors. Meanwhile, turnover plunged to a 2-week low and stood at LKR 540.4Mn, marking a 58.4% decrease from the monthly average standing at LKR 1.3Bn amidst the absence of the off-board transactions and low participation of the retail investors.

The Banking sector led the turnover with 20%, followed by the Food, Beverage and Tobacco and Capital Goods sectors jointly contributing 39% to the overall turnover. Furthermore, foreign investors remained net sellers, with a net foreign outflow of LKR 26.1Mn.

Bond Yield curve remains fixed ahead of monetary policy decision and bill auction

The secondary bond market yield curve remained broadly unchanged amidst limited activities and low trading volumes across the market, ahead of tomorrow’s monetary policy decision and bill auction.

Investors opted for a wait and see approach in anticipation of policy rate changes, and the results of the T-bill auction to be held on 24th July 2024.

At tomorrow’s weekly T-bill auction, CBSL is expected to raise LKR 160.0Bn through the issuance of LKR 45.0Bn from the 91-day maturity, LKR 45.0Bn is expected to be raised from the 182-day maturity, while LKR 70.0Bn is expected to be raised from the 364-day maturity.

Among the traded maturities, notable trades were amongst mid tenors, primarily the 2028 maturities, where 15.03.28, 01.05.28, 01.07.28, 01.09.28, and 15.09.29 were seen trading at rates of 11.75%, 11.82%, 11.80%, 11.95%, and 12.05% respectively.

Meanwhile, on the long end of the curve, 01.12.31 was seen trading at a rate of 12.42%. On the external front, LKR depreciated slightly against USD, closing at 303.72/USD compared to 303.69/USD recorded the previous day.

Meanwhile, CBSL Holdings of government securities remained unchanged at LKR 2,595.6Bn today. Overnight liquidity in the banking system contracted to LKR 52.63Bn from LKR 111.43Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..