The broader market witnessed another day of decline, influenced by ongoing uncertainties surrounding the external environment and the country's political landscape, compounded by potential margin selling.

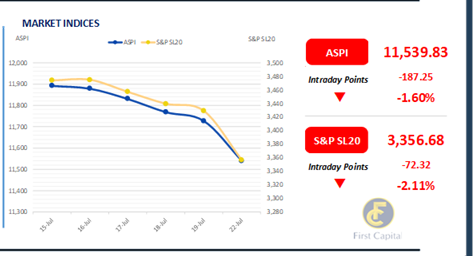

The ASPI commenced the week on a negative note and recorded the largest decline in three months, losing 187 points, and closed the day at 11,540. Banking sector counters and blue-chip stocks dragged the market down significantly.

However, there was a slight improvement in sentiment among retail investors, while the participation of HNWIs remained muted. On the back of muted participation from HNWIs, turnover stood at LKR 679.0Mn, marking a 51.2% decrease from the monthly average standing at LKR 1.4Bn.

The Capital Goods sector led the turnover with 40%, followed by the Food, Beverage and Tobacco and Banking sectors jointly contributing 28% to the overall turnover.

Furthermore, foreign investors turned net sellers, with a net foreign outflow of LKR 2.3Mn after 5 consecutive sessions of net foreign inflow. However, MTD net foreign inflow is at LKR 3.8Bn, signaling foreign investors' confidence in companies with strong growth potential and solid fundamentals.

Mixed sentiment wavers as monetary policy decision nears

The secondary market experienced mixed sentiment amidst limited activities and thin trading volumes ahead of the upcoming monetary policy announcement scheduled for the 24th of this week.

This mixed sentiment was particularly evident in the short-to-mid end of the yield curve, with the 01.02.26 and 15.12.26 maturities trading within the range of 10.20%-10.45%.

Additionally, the 01.09.28, 15.09.29, 15.05.30, and 01.12.31 maturities traded at 12.00%, 12.04%, 12.15%, and 12.42%, respectively. For the week ending 19th July 2024, the AWPLR increased by 27bps to 9.12% compared to the previous week, whilst AWDR stood at 8.38% as of June 2024.

Furthermore, foreign holdings in government securities decreased marginally by 0.85%WoW, registering at LKR 52.7Bn as of 18th July 2024. Consequently, the foreign holding percentage marginally decreased to 0.31% compared to the previous week.

Notably, the overnight liquidity for the day was recorded at LKR 111.4Bn, whilst CBSL holdings remained steady at LKR 2,595.6Bn. In the forex market, the LKR appreciated against the USD today, ending a three-session streak of depreciation, and settled at LKR 303.7.

Moreover, for the year up to 19th July 2024, the LKR has appreciated against the USD by 6.6%, reflecting a strong overall performance despite recent fluctuations.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..