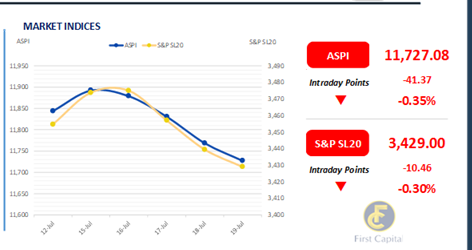

The Colombo bourse experienced a continued downturn as most of the banking sector stocks and mid-cap companies exerted negative pressure on the index as ASPI concluded the week in red for the fourth consecutive session, closing at 11,727, down by 41 points.

HNB, SAMP, NDB and DFCC coupled with SFCL emerged as the major negative contributors. Meanwhile turnover witnessed a 30.3% decrease from yesterday’s turnover and stood at LKR 784.4Mn, marking a 45.5% decline from the monthly average standing at LKR 1.4Bn amidst the low involvement of HNWI and retail investors.

The Capital Goods sector led the turnover with 54%, followed by the Food, Beverage and Tobacco and Banking sectors jointly contributing 26% to the overall turnover. However, foreign investors remained net buyers for the 5th consecutive day with a net inflow of LKR 165.8Mn.

Mixed end to the week post Bull Run

At the end of the week, the secondary market yield curve remained broadly stable amidst mixed activities witnessed across the board. Following a period of consecutive bullish sentiment earlier in the week, the market experienced a subdued session with thin trading volumes during the day.

Among the traded maturities, 01.02.26 and 15.12.26 maturities changed hands in the range of 10.20%-10.25% and 10.45%-10.50%, respectively. On the mid end, trades were observed at 11.75% for the 15.02.28 maturity and 11.80% for the 01.05.28 maturity.

Market sentiment extended to longer tenors as well, with the 15.09.29 and 01.12.31 maturities trading at 12.00% and 12.40%, respectively. Furthermore, the Central Bank of Sri Lanka has announced a Treasury Bill issuance totaling LKR 160.0Bn through an auction scheduled for 24th Jul 2024, slightly below the LKR 170.5Bn T-Bill maturing for the week ending 26th Jul 2024.

Meanwhile, out of the total auction, LKR 45.0Bn is to be raised from 91-day maturity, LKR 45.0Bn is expected to be raised from 182-day maturity while LKR 70.0Bn is to be raised from 364-day maturity. Moreover, in the forex market, the LKR further depreciated against the USD for the third consecutive day, settling at LKR 303.99.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..