The bourse continued its course in a negative direction amidst low investor sentiment. The market saw increased sentiment at the beginning of the day, while experiencing a decline in momentum over the course of the day.

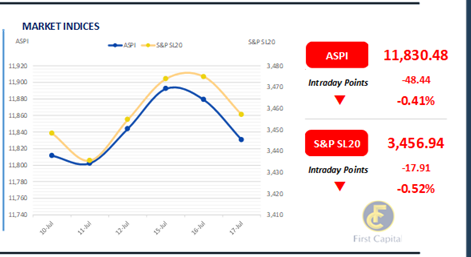

The ASPI closed at 11,830, marking a 0.41% decrease from the previous day, to which the most significant contributors were COMB, SPEN, JKH, RICH, and CTC. Conversely, MELS, SEMB, TJL, CARS, and TKYO were the most significant positive contributors towards ASPI.

Crossings taking place amongst JKH, HAYL, and HHL contributed considerably to overall turnover. Turnover saw an increase, standing at LKR 1.2Bn, where the Capital Goods sector led turnover by an immense amount at 77.1%, followed by the Materials, and Diversified Financials sectors jointly contributing 8.2% to overall turnover, further exhibiting volatility within the market.

The Banking sector saw a decline in its contributions to turnover, accounting for only 2.9% of overall turnover, reflecting negative sentiment and uncertainty surrounding the upcoming elections. There was a net foreign inflow of LKR 392.8BMn signaling interest in local investments.

Secondary market logs another week of falling auction yields

The secondary market saw a pre-auction buzz with moderate buying interest in short to mid-term maturities, where 01.06.26 and 15.12.27 traded at 10.65% and 11.65%, respectively.

Meanwhile, 4Yr tenors including 15.12.28 and 15.03.28 hovered within the range of 11.75%-11.70%, whilst 01.05.28 and 01.07.28 traded in the range of 11.82%-11.80%.

Furthermore, at the weekly T-bill auction held today, CBSL fully subscribed to the total offered amount of LKR 110.0Bn, whilst auction yields experienced a decline across the board for the second consecutive week.

CBSL accepted the total offered for the 91-day, 182-day, and 364-day maturities, at a WAYRs of 9.55% (-36bps), 9.78% (-32bps), and 10.07% (-14bps), respectively.

Post-auction, the market displayed mixed activity, where at the short-end of the curve, 01.08.26 witnessed buying interest at 10.50%, while mid-term bonds including 15.09.29 and 01.12.31 traded at 12.05% and 12.40%, respectively.

Moreover, overnight liquidity significantly improved to LKR 117.2Bn from the previous day's LKR 42.7Bn, whilst CBSL holdings remained unchanged at LKR 2,595.6Bn. On the external front, the LKR depreciated against the USD for the first time after six straight sessions of gains, closing at LKR 303.3/USD.

Courtesy: First capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..