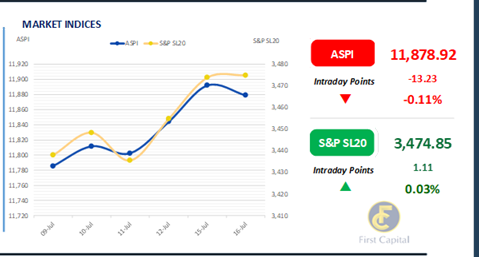

After 2 consecutive sessions in green, the Colombo bourse recorded a day of decline as index heavyweights dragged down the index during the latter half of the trading session.

Initially showing promise with a morning surge of over 50 points, the market's momentum faltered as investor confidence turned bearish, resulting the index to close at 11,879, losing13 points.

CINS, COMB, BIL, CFIN and MELS contributed to the index negative majorly. Retail participation remained stagnant, while HNWIs maintained a positive sentiment as turnover stood at LKR 1.1Bn, showing 26.9% down from the monthly average standing at LKR 1.5Bn.

SAMP stood out as the top contributor to turnover from foreign buying, accounting for 3 off-board transactions, while off-board transactions collectively made up 43.3% of the total turnover.

The Banking sector contributed 52% to the turnover whilst the Capital Goods and Food, Beverage and Tobacco sectors jointly contributed 28% to the overall turnover. However, foreign investors remained net buyers, with a net inflow of LKR 252.5Mn.

Buying appetite dominates bond market for the 2nd continuous day

The secondary bond market yield curve slightly adjusted downwards on the belly, as buying interest continued to dominate the market during the day.

Despite slight selling interest that hovered in the market, buying appetite remained strong, led by moderate participation as buyers accepted at the quoted offer rates.

Accordingly, bullish momentum rose predominantly on the 2028 tenor with 15.02.2028, 01.05.2028 and 01.07.2028 closing trades at 11.75%, 11.83% and 11.85%, respectively.

Meanwhile, 15.12.2027 enticed transactions at 11.70% levels. Moreover, on the mid end of the curve 15.09.2029 traded at 12.05% and 15.05.2030 traded at 12.10% while, on the long end, 01.12.2031 enticed business at 12.40%.

Meanwhile, investors await the outcome of the weekly auction scheduled for tomorrow following the decline in weighted average yield rates during the previous week.

Accordingly, CBSL expects to raise LKR 110.0Bn from the auction tomorrow, with LKR 30.0Bn being raised from both 91days and 182days maturities while LKR 50.0Bn is being raised from the 364days maturity.

On the external side, LKR continued to see appreciation against the greenback, closing at LKR 301.5. Meanwhile, overnight liquidity declined sharply today, registering at LKR 42.7Bn compared to yesterday’s closing of LKR 122.4Bn while CBSL holdings remained stagnant at LKR 2,595.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..