Bourse closed the week flat on the back of dull investor sentiment as retailers remain sidelined over delays in finalizing the DDR process. Index rallied in the beginning as buying interest on banking counters continued yet another day as investors speculated DDO proposal to be released soon.

However, selling pressure emerged mainly on blue-chip counters (SPEN, JKH and EXPO), which wiped off most of the gains as retailers chose to book profits and adopt a cautious stance after the index breached the psychological barrier of 8,700.

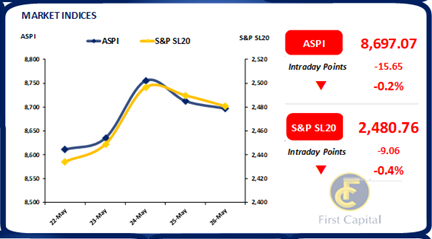

Accordingly, index closed the day flat at 8,697, losing 16 points. Although volumes continued to remain low, turnover was recorded at a respectable level of LKR 729.7Mn owing to the high institutional investor participation through off-board transactions of SIRA, CTC and DIAL.

Meanwhile, persisted buying spree on banks led the turnover with the contribution of 43% out of which HNB solely contributed 36%. Moreover, foreign investors turned net sellers amidst moderate participation recording a net outflow of LKR 226.0Mn.

Secondary debt market observes mixed activities

The secondary debt market witnessed mixed activities as investors are speculating favorable outcomes from the domestic debt optimization proposal which is to be released soon.

Meanwhile, amidst foreign selling and local buying, 01.07.32 maturity recorded trades between 23.25% -21.50%. Furthermore, in the forex market, LKR appreciated against the Greenback as it was recorded at LKR 303.05 at the end of the day, whilst the interbank spot rate closed at LKR 296.50.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..