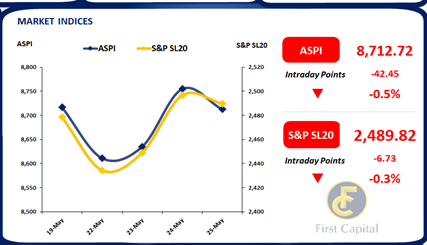

The share market commenced on an optimistic note yet succumbed to a downward trend towards the mid-day, and continued its volatile trajectory throughout the day with both ASPI and S&P closing in the red zone at 8,713, losing 42 points.

JKH topped the turnover during the day and witnessed an off-board transaction totaling 3.2Mn shares at LKR 140.0 through foreign buying. Furthermore, Watawala Plantations was amongst the biggest loser for the day after it reported a loss of LKR 262.7Mn for 4QFY23, representing a 133%YoY decline.

Meanwhile, as a result of the rupee appreciation, export counters such as EXPO witnessed lackluster investor sentiment. Moreover, following yesterday’s auction results, treasury shares came down as yield rates edged up by more than 8bps after two weeks. Market turnover was recorded at LKR 893.5Mn (+22.5% cf, monthly average turnover of LKR 729.4Mn) dominated by the Capital Goods sector (64%) and Food, Beverage & Tobacco sector (15%).

Secondary market yields dive down over buying

Despite limited activities, buying interest was visible on the secondary market as yields edged slightly low on 01.05.2027 and 15.09.2027 maturities which traded within a range of 26.95%-26.60%. Moreover, 15.01.2028 traded in the range of 25.10%-25.05% while 01.07.2032 enticed trades taking place at a range of 22.50%-22.00%. However, mixed interest was observed on short tenors with 01.05.2024 trading at 29.00% amidst thin volumes. In the forex market, LKR appreciated against the Greenback as it was recorded at LKR 303.3 at the end of the day.

Courtesy: First Capital Reserarch

Subscribe to our newsletter to get notification about new updates, information, etc..