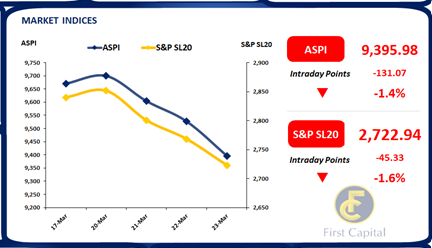

Bourse further dipped by 131 points and recorded at 9,396 primarily due to profit taking on the banking sector, which was the biggest contributor to the index today.

LIOC continued to decline with panic-selling as uncertainty emerged among investors as margins are expected to shrink due to possible fuel price revisions which will be determined based on the 2018 price formula.

Consumer services sector witnessed active investor participation driven by the tourism sector which experienced more than 76,000 tourist arrivals during the first three weeks of March 2023.

Mixed sentiment was observed on treasury shares despite a drastic dip in T-bill yields by 100bps. Market turnover was recorded at a substantial level hitting a 12-day high of LKR 3.4Bn (+85% cf. monthly average turnover of LKR 1.9Bn) contributed by the Food, Beverage & Tobacco sector (60%) and largely led by crossings. AGAL.N (45.3Mn shares at LKR 35.0) witnessed a stake change of c.29% through an off-board transaction with D R Industries (Private) Limited.

Secondary market active on thin volumes

Despite the deep plunge in treasury bill yields at yesterday’s auction, secondary market witnessed slight selling pressure arising from domestic debt restructuring concerns and profit taking which led to supply side pressures. Meanwhile, thin volumes were observed on the secondary market today, where 01.07.25 maturity was traded at 30.50%-30.75% range.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..