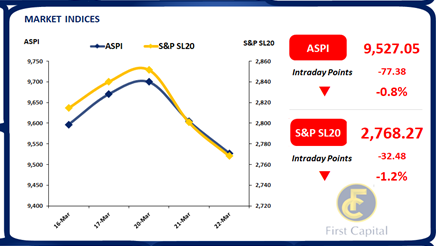

Index remained volatile and continued its downward trend since the previous session and closed the day at 9,527 losing 77 points. Investors remained on the sidelines and resorted to book profits amidst thin trading volumes in the market.

LIOC was amongst the top contributors to the negative sentiment following the press release from the minister of a possible downward adjustment in fuel prices owing to a decline in global fuel prices.

The banking counter showcased negative sentiment in the market due to restructuring concerns and treasury counters displayed active investor participation following the readjustment of bond and bill yield.

SLTL, LHCL and ECL remained the top gainers for the day as the treasury decided to divest major stakes of those counters.

Market turnover was recorded at a moderate level of LKR 1.5Bn (-20% cf. monthly average turnover of LKR 1.9Bn) contributed by the Telecommunication Services sector (28%) and Diversified Financials sector (15%).

Auction yields plunge sharply over 100bps

Continuing the persistent downtrend at weekly bill auction yields, weighted average yields at today’s primary auction plunged for the fourth consecutive week registering a significant dip across the board amidst a full acceptance.

Accordingly, weighted average yield rates of 03M maturity lowered to 26.23% (-171bps), 06M declined to 26.12% (-122bps) while 1Yr budged low to 24.32% (-160bps).

Meanwhile, in the secondary market during the morning session, maturities 01.05.2024, 01.06.2025 and 01.07.2025 traded within a range of 30.00%-29.75% amidst active buying interest. 2027 and 2032 maturities too witnessed buying interest during the day as 15.09.2027 traded in the range of 28.00%-27.80% while 01.07.2032 traded at 23.00%.

However, post auction selling interest emerged on the secondary market following the sharp dip in yields and as a result 01.07.2025 maturity observed trades taking place at a range of 30.10%-30.30% while volumes remained thin amidst limited activities.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..