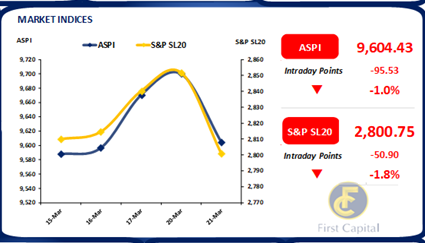

Despite the government securing the 48-month IMF Extended Fund Facility of about USD 3.0Bn deal yesterday, market surprisingly regressed to red during the day losing 96 points.

Bourse gained by over 500 points since the country reached the IMF staff-level agreement on 1st Sep 2022 and after securing the final deal yesterday, profit taking was witnessed mainly on bluechip companies.

Although index started on an uptrend, a sideways moment was witnessed afterwards mainly on Banking sector counters on the back of rising concerns of the possible domestic debt restructuring.

Turnover dipped to LKR 1.5Bn as investors wait for a clear direction on the macroeconomic front and interest rates movement ahead of the largest T-Bill auction which is scheduled for tomorrow.

Meanwhile, SLTL, LHCL and ECL remained the top gainers as the treasury decided to divest major stakes of those companies in order to raise funds for the government. Accordingly, Food, Beverage & Tobacco and Telecommunication services sectors led the market turnover with a joint contribution of 34%.

Buying dominates secondary market following IMF Board-level agreement

IMF yesterday approved the EFF of nearly USD 3.0Bn to Sri Lanka after the fulfillment of range of criterions. Subsequently, activities in the secondary market buoyed with perceptible buying interest where 01.05.2027 and 15.09.2027 traded at 27.50%.

However, selling interest was observed during the day on the same maturities as it hovered at 28.25% owing to the supply side pressures rising from government pay back of bonds to institutions.

Nevertheless, buying appetite remained dominant with 1Yr maturity traded at 24.00% and consequently 2027 maturity edged lower yet gain and traded in the range of 28.00%-27.90% while 01.07.2032 too witnessed some activity where it was traded at 23.00% amidst the strong buying interest.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..