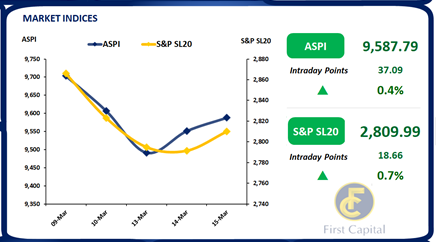

Bourse continued to settle firmly in the green zone trading positively throughout the day on the back of active collection witnessed on Banking sector counters as HNB and COMB remained the top contributors to the ASPI.

Index surged by 96 points in the beginning yet remained volatile afterwards as mixed sentiment was observed during the day as investors took a wait and see approach ahead of the mass protest following the trade union action against the tax hike.

Moreover, retail participation was witnessed on GLAS and TKYO as the government decided to settle the pending due to the construction counters.

With the slight improvement in the retail participation, turnover marginally improved to LKR 1.6Bn compared to the previous session (-19% cf. monthly average turnover of LKR 2.0Bn) and was largely led by Capital Goods, Materials and Banking sectors with a contribution of 25%, 21% and 21%, respectively. Meanwhile, YTD net foreign inflow surpassed LKR 3.5Bn amidst the significant foreign interest witnessed on JKH and HNB.

Treasury bill auction yields slide across the board to touch nearly 8-month low

CBSL conducted its weekly treasury bill auction today and raised a total of LKR 120.0Bn, as the total auction was fully subscribed and accepted. Furthermore, with continuous signals from central bank on easing future interest rates and possible signing of the IMF board level agreement in the coming weeks, weighted average yields came down across the board and touched nearly 8-month low, as 3-month bill yield declined by 81bps to 27.94% whilst 6-month and 12-month bill also recorded a sharp decline of 43bps and 51bps to 27.34% and 25.92%, respectively.

Meanwhile, apart from the weekly issue of bills from Central bank, supply-side pressure further intensified on the market due to increased bonds offered to government creditors, in an effort to settle the money owed by the government, thus 15.09.27 maturity recorded trades between 28.75%-28.25%.

Moreover, several trades were also noted on the 15.01.25 maturity which recorded trades at 31.50% whilst 01.06.25 maturity enticed trades at 31.10%. Further, 01.07.25 maturity was also active during the day, with trades taking place between 32.00%-31.40%.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..