The Colombo Bourse traded slightly lower during the session, as early gains were reversed by profit-taking, particularly in banking counters following their previous day’s rally.

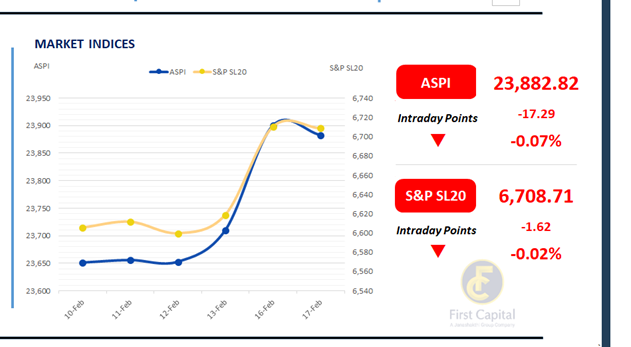

Indices recorded modest declines but recovered part of the losses toward the close. ASPI declined by 17 points to close at 23,883, while the S&P SL20 dropped 2 points, closing at 6,709. Leading negative contributors to the ASPI were CTHR, PABC, DIMO, DFCC and RICH.

Market breadth was negative, with 124 stocks declining compared to 105 advancers. HNW investor participation remained subdued, while retail investor activity was observed at average levels, particularly in retail trading stocks.

Daily turnover was below average level standing at LKR 4.2Bn. Turnover dropped 37.7% over the monthly average of LKR 6.8Bn. Capital Goods sector led the daily turnover with a share of 22%, followed by the Banking, and Food Beverage & Tobacco sectors collectively contributing 30%. Foreign investors remained net sellers, posting a net outflow of LKR 42.3Mn.

BOND MARKET

Selling pressure builds on long tenors

Today the 2029 segment saw mixed trading activity, while selling pressure emerged on the long tenors. Overall, the secondary market recorded moderate trading volumes, while the mid- and long-term yields slightly edged up.

Over 2029 category, 15.06.2029, 15.07.2029, 15.09.2029, 15.10.2029 and 15.12.2029 traded in the range of 9.35%-9.48%. Moving ahead, 01.03.2030 maturity traded within 9.51%-9.53%. Moreover, 15.03.2031, 01.10.2032, 01.06.2033, 15.06.2034 and 15.09.2034 changed hands at 9.72%, 10.12%, 10.40%, 10.65% and 10.67% respectively.

Towards the long-end, 15.06.2035, 01.07.2037 and 15.08.2039 were dealt at 10.75%, 10.85% and 10.92% respectively. On the external front, the LKR slightly depreciated against the USD, closing at LKR 309.22/USD compared to LKR 309.21/USD recorded the previous day.

Overnight liquidity in the banking system contracted marginally to LKR 270.41Bn from LKR 270.99Bn recorded previously

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..