The Colombo Bourse showed a mild downward drift throughout the session, with both indices slipping into the red and failing to sustain early momentum amid selling pressure and profit-taking.

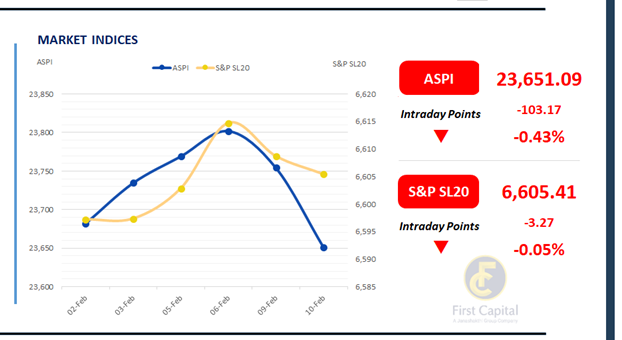

The ASPI declined by 103 points to settle at 23,651, while the S&P SL20 inched down by 3 points to close at 6,605, supported by a relatively slower pace of price declines in blue-chip stocks.

Top negative contributors to the ASPI were SFCL, CARG, DIAL, CFIN and DOCK. Meanwhile, share prices of 147 companies declined during the session, while only 67 recorded positive contributions.

HNW and retail investors’ participation remained subdued, leading to turnover levels below the monthly average. Daily turnover stood at LKR 3.5Bn, marking a decrease of 51.0% over the monthly average of LKR 7.2Bn.

Capital Goods sector led the daily turnover with a share of 20%, followed by the Materials, and Diversified Financials sectors collectively contributing 26%. Foreign investors remained net sellers, posting a net outflow of LKR 465.9Mn.

BOND MARKET

Mid-to-long tenures command sustained interest

Today marked a persistence in yesterday’s buying interest, particularly for mid-to-long tenure maturities. This in turn prompted a modest downward adjustment in the yield curve.

In terms of 2028 maturities, 15.02.2028 and 15.03.2028 traded within the narrow range of 8.95% to 8.98% while 01.05.2028, 01.07.2028, 15.10.2028 and 15.12.2028 traded higher between 9.00% to 9.12%.

Moving ahead, 15.06.2029 also changed hands within the narrow range of 9.42% to 9.45% while 15.10.2029 was seen trading at 9.50%. Further ahead on the yield curve, 01.03.2030 traded between 9.60% to 9.65% while 01.07.2030 was seen trading at 9.65%.

Similar to yesterday, mid tenures showed noteworthy activity with 15.03.2031 trading between 9.80%-9.85%, 01.10.2032 trading between 10.15%-10.17% while 15.01.2033 and 01.06.2033 traded at 10.40% and 10.50% respectively.

Finally, 15.06.2034 traded at 10.65% and at the long end of the curve, 15.06.2035 changed hands between 10.72% to 10.76% while 01.07.2037 traded at 10.95%.

On the external front, the LKR depreciated against the USD, closing at LKR 309.45/USD compared to LKR 309.38/USD recorded the previous day. Overnight liquidity in the banking system expanded yet again to LKR 282.22Bn from LKR 278.20Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..