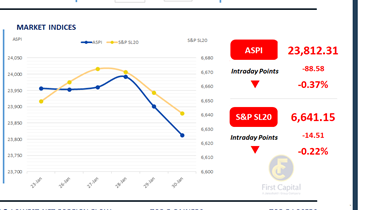

The Colombo Bourse continued yesterday’s profit-taking trend, with the market gradually easing after a brief early uptick. ASPI declined by 89 points to close at 23,812, while S&P SL20 dropped by 15 points to close at 6,641.

Top negative contributors to the ASPI were HAYL, RICH, BUKI, BREW and HARI. HNW participation remained strong, particularly in blue-chip counters, with crossings totaling LKR 3.5 Bn, accounting for 37.6% of the day’s total turnover.

Retail investor activity remained at average levels. Daily turnover recorded at a high level standing at LKR 9.2Bn, 40.5% increase over the monthly average of LKR 6.5Bn.

Capital Goods sector led the daily turnover with a share of 45%, followed by the Banking, and Diversified Financials sectors collectively contributing 33%. Foreign investors remained net sellers, posting a net outflow of LKR 1.7Bn.

Secondary market holds steady amid mixed sentiment

The secondary market witnessed moderate trading volumes and mixed sentiment during the session, resulting in the overall yield curve remaining unchanged. In the short-tenor segment, the 15.03.2028 traded at 9.02%, while the 01.05.2028 and 01.07.2028 maturities traded in the 9.10%-9.15% range. The 15.12.2028 was seen trading at 9.21%.

In the 2029 segment, the 15.10.2029 and 15.12.2029 traded between 9.60% and 9.65%. Further along the curve, the 01.03.2030 traded in the 9.70%-9.72% range, while the 15.05.2030 and 01.07.2030 traded between 9.73% and 9.76%. In the 2031 segment, the 15.03.2031 and 15.05.2031 traded between 9.92% and 10.05%.

The 01.10.2032 maturity traded at 10.28%, while the 01.06.2033 traded in the 10.65%-10.67% range. The 15.06.2034 maturity was seen trading between 10.80% and 10.85%, and the long end, 15.06.2035, traded at 10.92%.

On the external front, the LKR appreciated against the USD, closing at LKR 309.50/USD compared to LKR 309.65/USD seen previously. Overnight liquidity in the banking system expanded to LKR 233.13Bn from LKR 194.26Bn recorded previously.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..