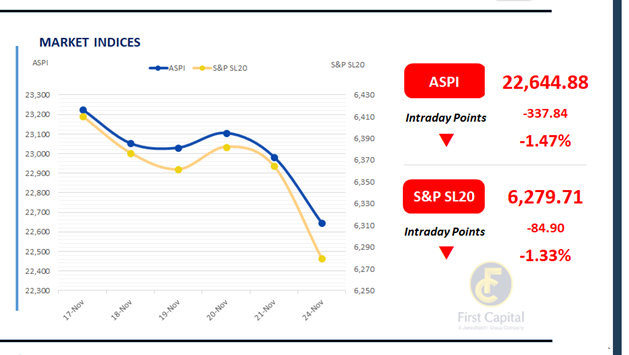

The Colombo Bourse witnessed sustained selling pressure, accompanied by higher turnover compared to the previous week. Retail participation made a notable contribution to today's market activity.

Driven largely by movements in banking and blue-chip counters, the ASPI fell by 338 points, closing the session at 22,645. HNB, RICH, NDB, SAMP and JKH emerged as the top negative contributors to the index.

Turnover reached LKR 4.9Bn, which is 17.5% below the monthly average of LKR 6.0Bn. Significant activity was observed in HHL and YORK, supported by crossings.

Capital Goods sector dominated the activity, accounting for 33% of total turnover, while Banking and Food Beverage and Tobacco sectors collectively contributed 28%. Foreign investors turned net buyers, recording a net inflow of LKR 83.2Mn.

BOND MARKET

Yield curve holds steady amid low volumes

The secondary bond market began the week with subdued trading volumes, leading to a generally stable yield curve, which showed little movement over the period. At the shorter end of the curve, the 01.06.2026 bond saw trading at a yield of 8.20%, while the 15.03.2028 maturity traded slightly higher at 9.02%.

Moving further out, the 01.07.2030 bond traded at 9.60%. On the longer end, the 15.09.2034 maturity exchanged hands at 10.58%, and the 15.06.2035 bond was traded within a range of 10.65% to 10.70%.

On the external front, the LKR slightly appreciated against the USD, closing at LKR 308.0/USD compared to LKR 308.3/USD seen previously. Overnight liquidity in the banking system contracted to LKR 58.5Bn from LKR 78.3Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..