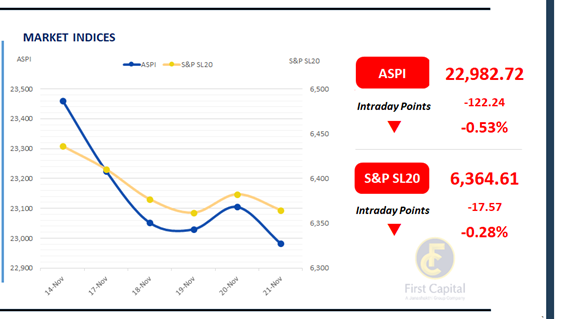

The Colombo Bourse reverted to profit booking and ended the day in negative territory, marking the week’s closure in red. Cashing in by investors pushed the ASPI down by 122 points to end at 22,983.

Lower turnover levels indicated subdued retail and HNW participation. HNB, BUKI, GREG, SFCL and CARG emerged as the key negative contributors to the index.

Daily market turnover registered at LKR 3.8Bn, reflecting a 38% decline compared to the monthly average of LKR 6.1Bn. The Food, Beverage & Tobacco sector dominated activity, accounting for 25% of total turnover, while the Capital Goods and Banking sectors collectively contributed 36%.

Foreign investors remained net sellers, recording an outflow of LKR 163.9Mn for the day.

BOND MARKET

Yield curve holds steady as mixed sentiment continues

The secondary market saw mixed sentiment with low volumes and subdued activity, while the yield curve remained unchanged.

Among the traded maturities, 15.10.2029 and 15.12.2029 were seen trading at 9.50%. Meanwhile, some selling interest emerged in the 01.07.2032, 01.10.2032, and 15.12.2032 maturities, which traded in the range of 10.25% to 10.30%.

On the external front, the LKR slightly appreciated against the USD, closing at LKR 308.25/USD compared to LKR 308.47/USD seen previously.

Furthermore, the LKR has depreciated 5.4% year-to-date. Overnight liquidity in the banking system contracted to LKR 78.3Bn from LKR 102.6Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..