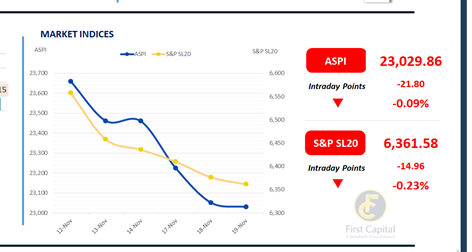

Following yesterday’s trend, the Colombo Bourse opened on a weaker note, with the ASPI dipping during early trading before partially recovering in the latter half of the session.

Despite the rebound, the index closed in negative territory at 23,030 points, marking a modest decline of 22 points compared to the previous session. Retail and HNW participation remained comparatively muted throughout the day.

Notably, investor interest was elevated on JFP during its first day of trading. COMB, DIAL, DOCK, DFCC, and NDB were the major negative contributors to the index.

Daily market turnover stood at LKR 3.8Bn, representing a significant 42% drop relative to the monthly average of LKR 6.6Bn. The Materials sector led market activity, accounting for 26% of total turnover, while the Capital Goods and Banking sectors collectively contributed 38%.

Meanwhile, foreign investors remained net sellers, recording an outflow of LKR 4.7Mn for the day.

BOND MARKET

Mixed sentiment meets steady continuation

Similar to yesterday, the secondary bond market depicted mixed sentiment with moderate trading volumes, with the yield curve remaining steady.

Among the trades that took place, 15.01.2028 and 15.02.2028 maturities traded at 9.00%. While 15.10.2028 traded at 9.07%, 15.09.2029 traded at 9.47%.

Both 15.05.2030 and 15.07.2030 maturities changed hands at 9.60%. Towards the long end of the curve, 01.11.2033 traded at 10.45% and 15.06.2035 traded between 10.65%-10.69%.

The CBSL conducted its weekly T-Bill auction today, raising LKR 63.1Bn, falling short of the offered amount of LKR 86.0Bn. The 3M bill raised LKR 4.0Bn, falling short of its initial offer of LKR 16.0Bn, while the yield remaining unchanged at 7.52%.

The 6M bill raised the same amount as its initial offer of LKR 45.0Bn, with the yield remaining unchanged at 7.91%. Meanwhile, the 12M bill raised LKR 14.1Bn, falling below its initial offer of LKR 25.0Bn, as the yield changed by 1bps to 8.03%.

On the external front, the LKR slightly appreciated against the USD, closing at LKR 307.8/USD compared to LKR 307.9/USD seen previously. Overnight liquidity in the banking system marginally expanded to LKR 95.62Bn from LKR 87.79Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..