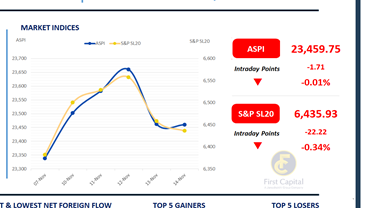

The Colombo Bourse dipped below the 23,300 level during early trading but gradually regained ground in the latter part of the session. The ASPI ultimately closed marginally in negative territory, shedding 2 points to end at 23,460.

Retail participation remained moderate, while HNW activity was relatively subdued. MELS, SAMP, DIMO, HAYL, and RICH were the major negative contributors to the index.

Market turnover reached LKR 5.6Bn, reflecting a 17% decline compared to the monthly average of LKR 6.8Bn. The Banking sector led activity, accounting for 25% of total turnover, followed by the Capital Goods and Food, Beverage & Tobacco sectors, which collectively contributed 34%.

Meanwhile, foreign investors remained net sellers, recording a net outflow of LKR 5.9Mn for the day.

BOND MARKET

Selling interest surfaces amid soft market activity

The secondary bond market exhibited a degree of selling interest today; however, overall activity remained subdued relative to previous sessions, resulting in an unchanged yield curve.

At the short end, the 15.03.2028 maturity traded at 9.00%, while the 15.10.2028 was quoted at 9.07%. In the 2029 segment, both the 15.09.2029 and 15.10.2029 issues traded within the 9.45%–9.48% range.

Further along the curve, the 01.07.2032 and 15.12.2032 maturities traded between 10.20% and 10.30%. The 15.06.2035 issue concluded trading at 10.70%. On the external front, the LKR depreciated against the USD, closing at LKR 305.22/USD compared to LKR 304.52/USD seen previously.

Overnight liquidity in the banking system contracted to LKR 136.12Bn from LKR 162.43Bn recorded on the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..