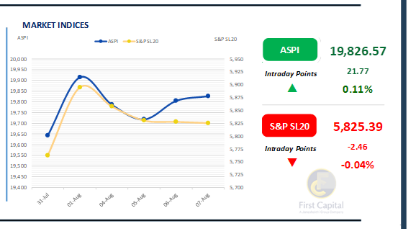

The Colombo Bourse extended its positive momentum from yesterday, closing in the green once again marking a turnaround from the sluggish start to the week.

Despite the upbeat closure, trading was marked by significant volatility, driven by a mix of buying and selling activity. The ASPI gained 22 points, ending this shortened trading week at 19,827.

Market engagement remained relatively muted, with limited participation from both retail and high-net-worth investors. Today's turnover amounted to LKR 3.3Bn, marking a 52% decrease from the monthly average of around LKR 6.8Bn.

The Diversified Financials sector dominated turnover, contributing 23%, followed by the Capital Goods, and Banking sectors with a combined contribution of 33%. Foreign investors remained net buyers, recording a net inflow of LKR 27.0Mn.

BOND MARKET

Muted action wraps up the trading week

The secondary bond market withstood a lukewarm day ahead of the impending long weekend. Notable transactions were scarce, though measured interest was evident in the short to mid end of the curve.

At the short end of the curve, 15.10.2027 was seen changing hands at 8.60%. In terms of 2029 maturities, 15.09.2029 and 15.10.2029 traded between 9.37% to 9.38% while 15.12.2029 traded marginally higher at 9.40%.

Moving ahead, 15.10.2030 maturity traded at 9.55%. Finally, 01.07.2032 and 15.12.2032 traded at 10.45% and 10.30% respectively. In the forex market, the LKR appreciated slightly against the greenback, closing at LKR 300.8/USD, compared to the previously seen rate of LKR 300.9/USD.

Meanwhile, overnight liquidity in the banking system dipped to LKR 88.5Bn from the previously seen level of LKR 92.1Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..