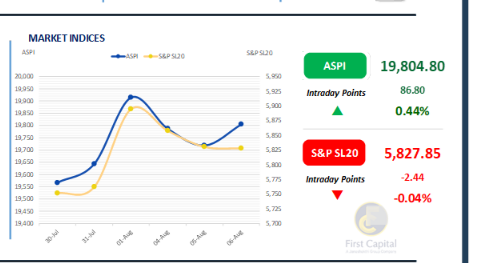

Reversing the selling sentiment seen yesterday, the Colombo Stock Market witnessed renewed buying interest today, with increased participation from high-net-worth investors.

The index saw a sharp rise during the early hours of trading, driven by bargain hunting. However, momentum slowed thereafter, leading to a period of sideways movement.

Despite this, the market closed in positive territory, with the index gaining 87 points to end the day at 19,805. MELS, PINS, CARS, COOP, and GLAS were the top contributors to the index during today.

Additionally, subdued participation from retail investors was also observed. Amidst multiple crossings, daily turnover amounted to LKR 4.5Bn, marking a 35% decrease from the monthly average of LKR 6.7Bn.

The Capital Goods sector dominated turnover, contributing 24%, followed by the Materials and Banking sectors with a combined contribution of 33%. Foreign investors turned net buyers, recording a net inflow of LKR 9.2Mn.

BOND MARKET

Secondary market stagnates amid low trading activity

The secondary market endured another subdued session, resulting in minimal movement along the yield curve. Trading volumes remained thin, with few notable transactions recorded.

On the shorter end, the 01.07.2028 maturity was traded within a narrow band of 8.80% to 8.82%. Further along the curve, the 15.12.2029 maturity saw trades between 9.39% to 9.40%.

Meanwhile, the 01.07.2030 maturity changed hands at a yield of 9.50%. The Central Bank concluded its weekly Treasury Bill auction today, fully raising the initially offered amount of LKR 82.0Bn.

The 3M bill generated LKR 28.3Bn, with its weighted average yield decreasing by 1bp to 7.61%. The 6M bill raised LKR 33.9Bn, with yield remaining unchanged at 7.91%. Meanwhile, the 12M bill drew LKR 19.8Bn, with yield remaining unchanged at 8.03%.

The CBSL has scheduled an LKR 65.0Bn worth bond auction on 12th August 2025, offering two maturities, namely LKR 40.0Bn maturing on 01.01.2032 and LKR 25.0Bn maturing on 15.06.2035.

In the forex market, the LKR appreciated against the greenback, closing at LKR 300.9/USD, compared to the previously seen rate of LKR 301.0/USD. Meanwhile, overnight liquidity in the banking system dipped to LKR 92.1Bn from the previously seen level of LKR 93.3Bn

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..