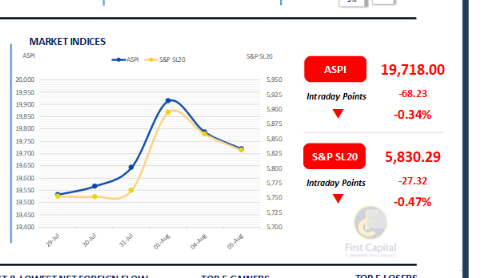

Reflecting yesterday's selling pressure, the Colombo Bourse experienced a downward trend accompanied by market volatility. The index dropped sharply during the early trading hours but later recovered somewhat due to bargain buying, although it was unable to close in positive territory.

Today, the ASPI ended at 19,718, down 68 points. Similar to yesterday, diversified conglomerates such as JKH, MELS, and VONE, along with Banking sector stocks like DFCC and COMB, weighed heavily on the index.

Additionally, subdued participation from retail and HNW investors was also observed compared to previous sessions. Amidst limited crossings, daily turnover amounted to LKR 3.3Bn, marking a 53% decrease from the monthly average of LKR 7.1Bn.

The Capital Goods sector dominated turnover, contributing 30%, followed by the Banking and Diversified Financial sectors with a combined contribution of 35%. Foreign investors remained net sellers, recording a net outflow of LKR 145.4Mn.

Yields hold steady amid dormant activity

The secondary market withstood yet another lethargic session prompting the yield curve to remain largely static. Today's trading volumes were limited, and significant transactions were scarce.

Amongst the few trades that took place, 15.06.2029, 15.07.2029, 15.09.2029 and 15.10.2029 traded at 9.30%, 9.40%, 9.35% and 9.36% respectively. Moving ahead, 15.05.2030 was seen changing hands at 9.47% while 15.07.2030 and 15.10.2030 both traded within 9.45% to 9.57%.

In the forex market, the LKR appreciated against the greenback, closing at LKR 301.0/USD, compared to the previously seen rate of LKR 301.6/USD. Meanwhile, overnight liquidity in the banking system dipped marginally to LKR 93.3Bn from the previously seen level of LKR 94.0Bn

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..