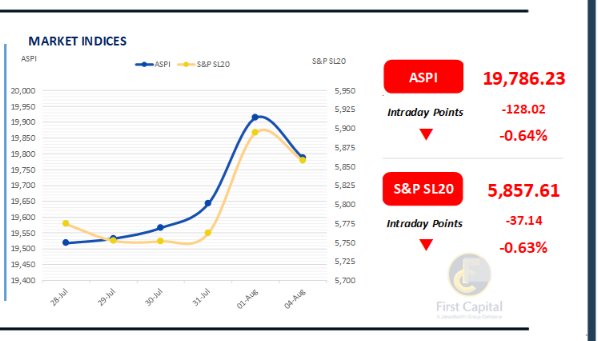

The Colombo Stock Market faced selling pressure today after the index briefly crossed the psychological 20,000 mark in early trading. However, the upward momentum was short-lived, as a wave of selling dragged the market lower.

By the close of trading, the index had dropped 128 points, ending the day in the red at 19,786. Banking sector stocks and conglomerates exerted negative pressure on the index, with JKH, MELS, NDB, AEL, and BUKI emerging as the top negative contributors.

Daily turnover amounted to LKR 4.5Bn, marking a 37% decrease from the monthly average of LKR 7.2Bn. The Banking sector dominated turnover, contributing 30%, followed by the Capital Goods and Diversified Financial sectors with a combined contribution of 30%. Foreign investors remained net sellers, recording a net outflow of LKR 8.2Mn.

Subdued secondary market activity amid low volumes

The secondary market remained muted today, with overall trading volumes staying low and notable transactions being sparse. At the short end of the yield curve, bonds maturing on 15.02.2028, 15.03.2028 and 15.10.2028 traded in the 8.67% to 8.85% range.

Moving into the 2029 maturities, 15.06.2029, 15.10.2029 and 15.12.2029 traded in the 9.30% to 9.40% range. Further along the curve, 01.07.2030 maturity was exchanged at 9.50% to 9.51%, and the 01.10.2030 maturity traded between 9.55% to 9.75%.

In the forex market, the LKR appreciated against the greenback, closing at LKR 301.6/USD, compared to the previously seen rate of LKR 302.2/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 94.0Bn from the previously seen level of LKR 76.3Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..