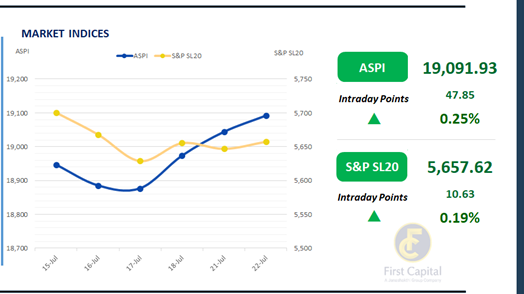

The Bourse extended yesterday’s momentum into today’s session, supported by increased investor participation and sustained positive sentiment. The ASPI advanced further, gradually settling into the newly surpassed 19,000 zone and closing at 19,092 with a gain of 48 points.

The index experienced notable intraday volatility, briefly dipping into negative territory until late morning, before recovering steadily on the back of improved sentiment which drove consistent gains throughout the afternoon.

The top positive contributors to the index were DFCC, NDB, AEL, HNB and ASHO. Both retail and HNW investors contributed to the active trading environment observed today. Turnover for the day stood at LKR 5.9Bn, which reflects a 17% decrease over the monthly average of LKR 7.1Bn.

The Banking sector dominated activity, accounting for a 23% share, followed by the Capital Goods, and Food, Beverage & Tobacco sectors which collectively contributed around 37%. Foreign investors remained net sellers with a net outflow of LKR 38.2Mn.

Secondary market extends its quiet streak

The Secondary market withstood yet another muted day of trading as investors remained on the sidelines, having adopted a wait-and-see approach ahead of the monetary policy decision set to be announced tomorrow.

Consequently, trading volumes were limited and the yield curve held firm. Amongst the few trades that took place, the noteworthy ones were even fewer. At the short end of the curve, 15.10.2028 was seen changing hands at 9.00%.

Further ahead on the yield curve, the 15.10.2029 maturity traded at 9.45%. Given the dormant nature of today’s session, the significant trades were scarce and limited to the above. In the forex market, the LKR depreciated against the greenback, closing at LKR 301.8/USD, compared to the previously seen rate of LKR 301.6/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 98.4Bn from the previously seen level of LKR 103.9Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..