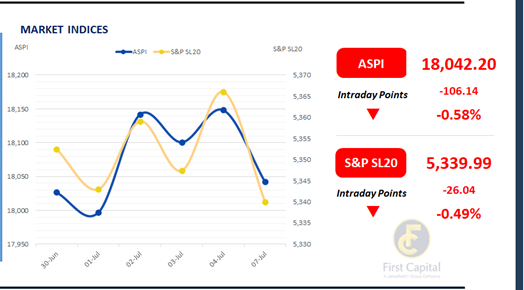

The Colombo Stock Exchange started the week off on a dull note with dormant investor participation and weak sentiment. The ASPI remained volatile throughout the session, ultimately dipping by around 106 points to close in the red at 18,042.

The index fell sharply at the open and staged a brief rebound before reversing course and succumbing to selling pressure that dragged it down. Notable contributors to the downturn included MELS, HNB, COMB, SPEN, and NDB. Surrounding the uncertainty around the verdict on the U.S. tariffs, both retail and HNW investors remained cautious and opted for a wait and see stance.

Turnover stood subdued at LKR 2.4Bn, reflecting a 53% decrease from the monthly average of LKR 5.1Bn. The Capital Goods sector was the top contributor to today’s turnover, accounting for a share of 23%.

This was followed by the Banking, and Diversified Financials sectors which produced a joint contribution of about 37%. Foreign investors remained net buyers with a net inflow of LKR 69.9Mn.

Thin trading leaves yield curve on a standstill

Trading in the secondary market started the week with subdued activity, leaving the yield curve largely unchanged. Notable trades included the 15.02.2028 and 15.03.2028 maturities trading at the rate of 8.75%, while the 01.05.2028 and 15.06.2029 maturities exchanged hands at the rates of 8.80% and 9.35%, respectively.

The CBSL has scheduled an LKR 200.0Bn worth bond auction on 11th July 2025, offering three maturities, namely LKR 75.0Bn maturing on 15.09.2029; LKR 75.0Bn maturing on 01.06.2033; and LKR 50.0Bn maturing on 15.09.2034 respectively. In the forex market, the LKR depreciated marginally against the greenback, closing at LKR 300.2/USD, compared to the previously seen rate of 300.0/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 88.6Bn from the previously seen level of LKR 96.5Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..