The Colombo Bourse staged a mild recovery from yesterday’s profit-taking, with investors remaining engaged throughout.

The market opened under continued selling pressure, carried forward from the previous day, driven by uncertainty surrounding the verdict on U.S. reciprocal tariffs, which prompted investors to resort to further profit taking.

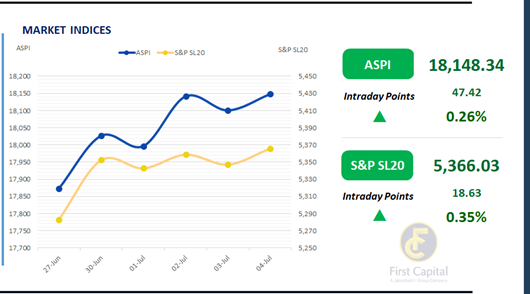

The ASPI showcased a declining trend until late morning, after which it saw steady gains as investor sentiment shifted towards a buying stance. The index ultimately closed at 18,148, marking a gain of 47 points.

The top positive contributors for the day were JKH, MELS, COMB, HNB and SUN. Today’s rally was driven by HNW investors, with crossings in CTHR and CARG accounting for a significant portion of the turnover, while retail investor activity remained moderate.

Turnover stood at LKR 6.8Bn, which marks a 31% increase over the monthly average of LKR 5.2Bn. The Food Retailing sector was the top contributor to today’s turnover, accounting for a share of 32%.

This was followed by the Capital Goods, and Materials sectors, which produced a joint contribution of about 31%. Foreign investors turned net buyers, with a net flow of LKR 17.2Mn.

A dormant session marked by mixed sentiment

As the week wound down, the secondary market settled into a rather subdued rhythm. Overall sentiment was mixed, with trading activity particularly evident in the 2028 and 2029 segments of the curve.

With volumes on the lighter side, today marks a quiet end to an otherwise measured week. On the short end of the curve, 15.02.2028 traded at 8.75% and 15.03.2028 traded slightly lower at 8.72% while 01.07.2028 and 15.10.2028 were seen trading at 8.85% and 8.90% respectively.

In terms of the 2029 maturities, 15.06.2029 traded at 9.42%, while 15.12.2029 changed hands marginally higher at 9.43%. Moving ahead on the yield curve, 15.05.2030 traded at 9.55%. Finally, the 01.12.2031 maturity was seen changing hands at a rate of 10.00%.

In the forex market, the LKR depreciated marginally against the greenback, closing at LKR 300.00/USD, compared to the previously seen rate of 299.99/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 96.5Bn from the previously seen level of LKR 91.1Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..