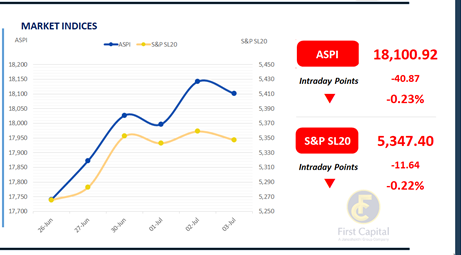

Colombo Bourse faced selling pressure today as investors booked profits. The ASPI fell by 41 points, to close the day at 18,000. Leading the decline were HAYL, CTHR, DOCK, GRAN, and SAMP, which acted as the main drag on the index.

Meanwhile, stocks in the Construction sector attracted notable investor interest during the session. Retail and HNW investor participation remained notably strong throughout the session.

Turnover for the day stood elevated at LKR 5.7Bn, representing a 9% increase from the monthly average of LKR 5.2Bn. The Capital Goods sector was the top contributor to today’s turnover, accounting for a share of 26%.

This was followed by the Banking and Material sectors which made a joint contribution of around 31%. Foreign investors remained net sellers, with a net outflow of LKR 48.3Mn.

Focused interest persists; yields stay anchored

Today’s market tone was marked by selective buying interest, including pockets of foreign participation. 2029 maturities garnered noteworthy investor interest while 2028 maturities also drew consistent interest.

Overall market volumes were moderate, reflecting a cautious yet constructive tone amid selective positioning. Amongst the 2028 maturities that were traded 15.03.2028, 01.07.2028 and 15.12.2028 traded between 8.70% to 8.83%.

In terms of 2029 maturities, 15.06.2029, 15.09.2029, 15.10.2029 and 15.12.2029 were seen changing hands between 9.30% to 9.40%. Moving ahead on the yield curve 15.12.2032 traded at a rate of 10.35%. In the forex market, the LKR appreciated against the greenback, closing at LKR 299.99/USD, compared to the previously seen rate of 300.02/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 91.1Bn from the previously seen level of LKR 99.4Bn

Courtesy: First capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..